by RMLS Communication Department | Jul 31, 2009

With all the stories in the media, it seems like everyone is facing foreclosure these days. (Even Michael Jackson’s doctor.) So I thought it would be interesting to look at the foreclosure market in our service area to find out what’s really going on.

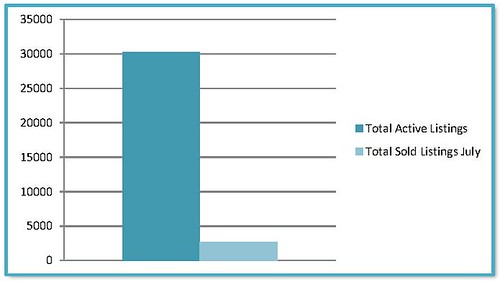

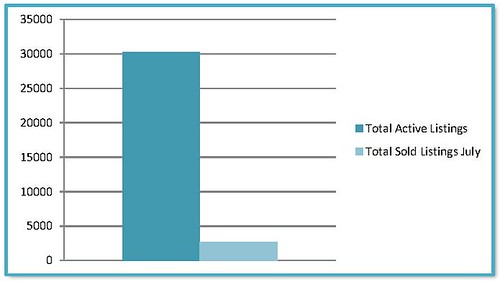

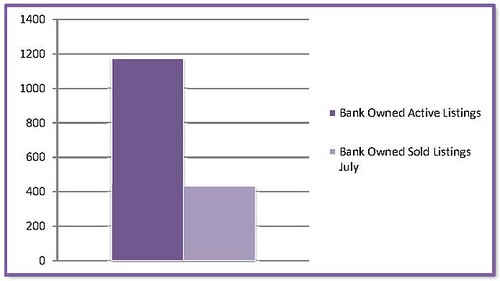

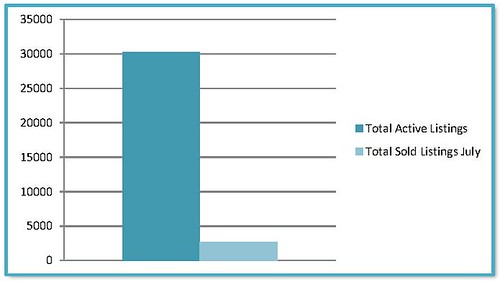

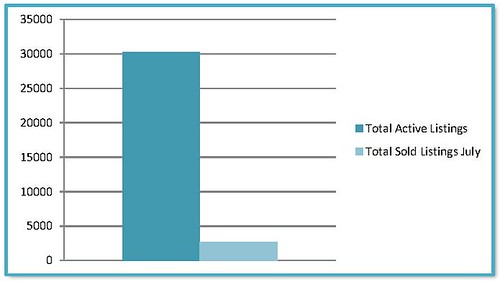

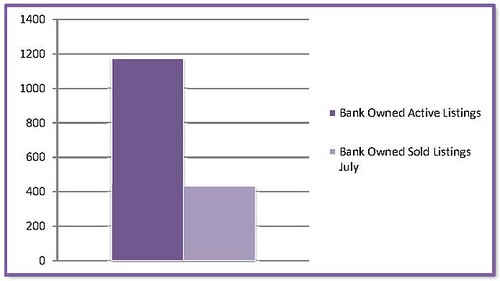

We currently have 30,276 active residential listings in RMLSweb–this includes Oregon and Washington. Of those, 1,172 are marked as Bank Owned. That’s approximately 3.9%.

Out of curiosity, I took my research a little further to find out how well Bank Owned properties are selling versus the entire inventory in our markets. So far in July 2009, 2,707 properties in our entire database sold. According to my research, 430 of them were marked Bank Owned.

If we didn’t add any more listings of any kind to RMLSweb and the active residential properties kept selling at the same rate they did in July it would take 11.2 months to sell our entire inventory and only 2.7 months to exhaust the inventory of Bank Owned Properties.

Granted, it’s only the morning of the last day of July so it’s likely that we’ll see the numbers of sales go up over the next few days, but this should give you a snapshot of what’s going on with Bank Owned properties.

by RMLS Communication Department | Jul 23, 2009

Lots of people are talking about short sales and foreclosures these days. If you didn’t know better, you might think that they’re the dominant type of listing for sale. But fortunately, you do know better and starting next week when we add two new short sale fields to RMLSweb (more on that later) it’s going to be even easier for you to keep tabs on these distressed properties.

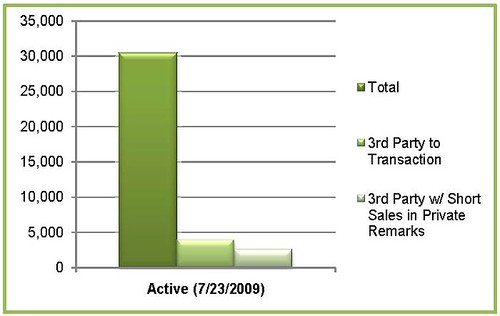

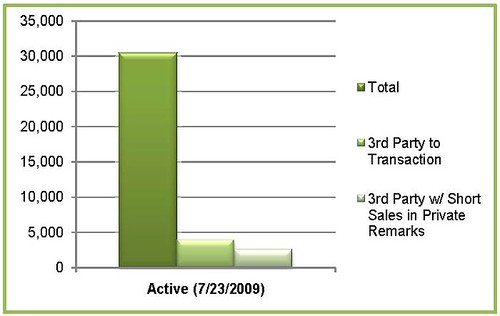

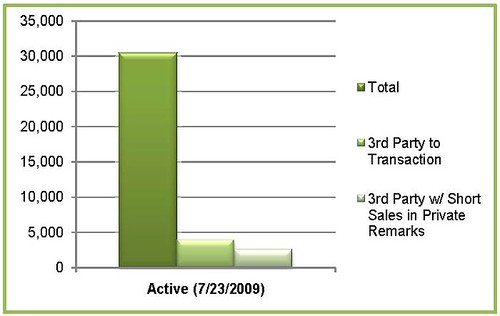

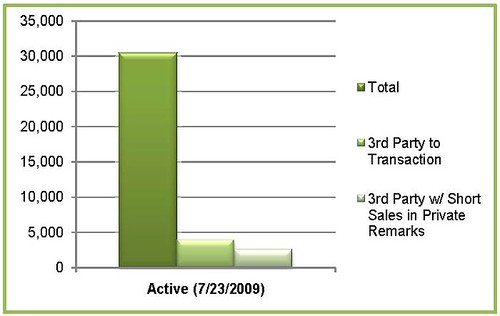

The graph below shows you the total number of active listings in RMLSweb as of today, July 23, 2009, compared with the number of active listings that are checked 3rd Party to Transaction Yes – approximately 12.8%.

(Since 3rd Party to Transaction doesn’t necessarily mean it’s a short sale – it could also be an estate sale or relo property, for example – I’ve also included the number of 3rd Party to Transaction that mention short sale in the Private Remarks.)

The next logical question is how well are these properties selling? To help answer that here’s another chart that shows the number of listings marked 3rd Party to Transaction Yes that are currently active , currently pending and that sold in the first half of the year.

As I mentioned earlier, 3rd Party to Transaction Yes does not necessarily mean a listing is a short sale. Therefore, to handle short sales more efficiently and to help the other types of properties that require 3rd Party approval to get fair attention, the RMLS™ Board of directors voted to add the following fields to RMLSweb:

Short Sale Yes/No – will be required when entering a listing and 3rd Party to Transaction will be automatically checked when Yes is selected.

Short Sale Offer (Seller Accepted; Submitted for Approval) Yes/No – The rules will be revised to require updating this field when an offer is made.

For more information on short sales see the National Association of Realtors Field Guide to Short Sales.

P.S. Be sure to check back for statistics on Bank Owned properties to come soon.