Do Foreclosures Dominate RMLS™ Market Areas?

With all the stories in the media, it seems like everyone is facing foreclosure these days. (Even Michael Jackson’s doctor.) So I thought it would be interesting to look at the foreclosure market in our service area to find out what’s really going on.

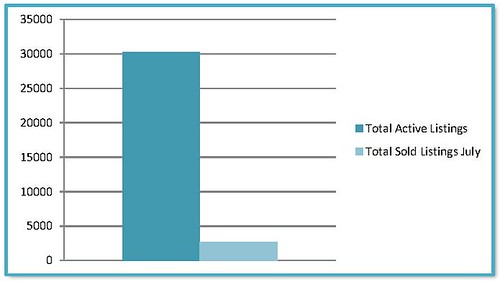

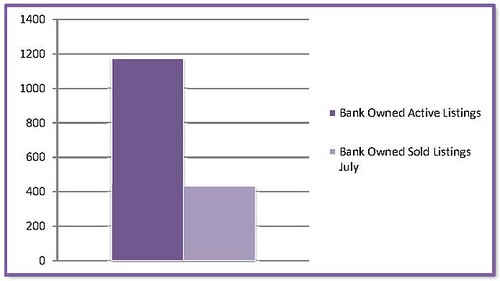

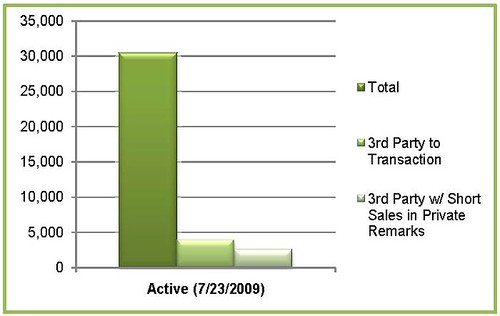

We currently have 30,276 active residential listings in RMLSweb–this includes Oregon and Washington. Of those, 1,172 are marked as Bank Owned. That’s approximately 3.9%.

Out of curiosity, I took my research a little further to find out how well Bank Owned properties are selling versus the entire inventory in our markets. So far in July 2009, 2,707 properties in our entire database sold. According to my research, 430 of them were marked Bank Owned.

If we didn’t add any more listings of any kind to RMLSweb and the active residential properties kept selling at the same rate they did in July it would take 11.2 months to sell our entire inventory and only 2.7 months to exhaust the inventory of Bank Owned Properties.

Granted, it’s only the morning of the last day of July so it’s likely that we’ll see the numbers of sales go up over the next few days, but this should give you a snapshot of what’s going on with Bank Owned properties.