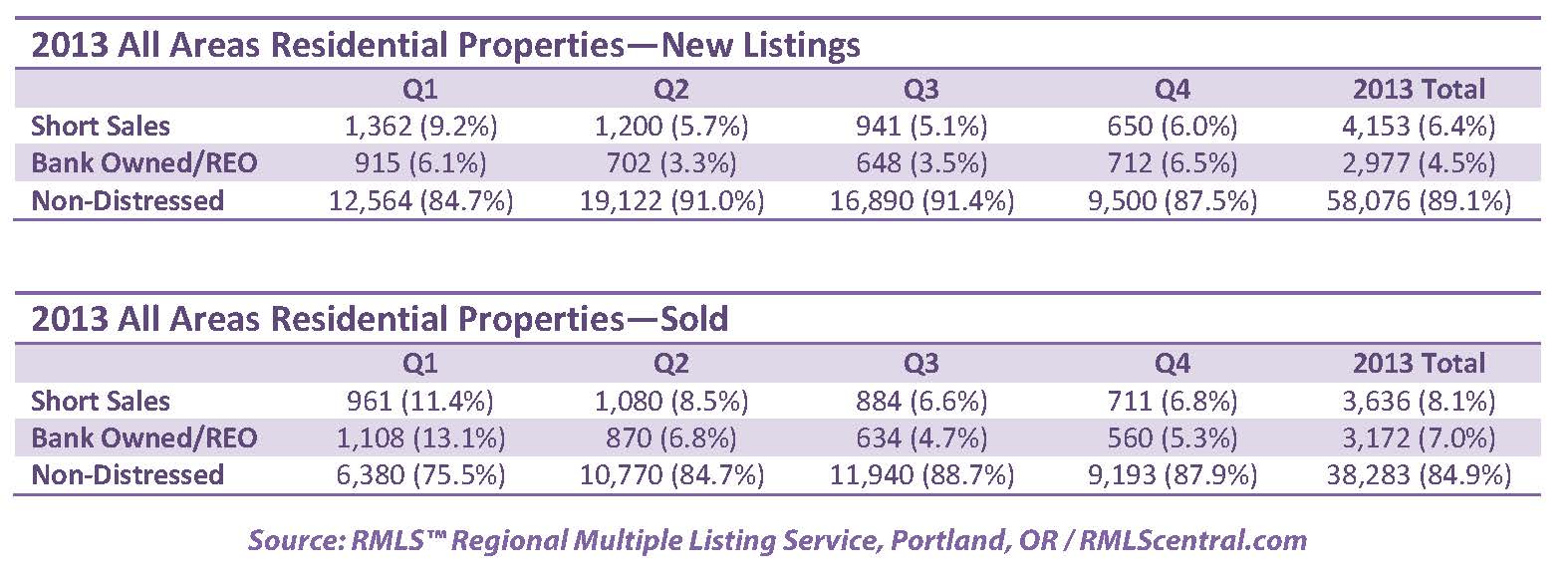

2016 Distressed Residential Properties

The chart below shows the number of bank owned/REO and short sales in all areas of the RMLS™ system during 2016.

All areas when comparing percentage share of the market 2015 to 2016:

• Comparing 2015 to 2016, distressed sales as a percentage of closed sales decreased from 8.8% to 6.5%.

• New listings increased from 73,624 to 74,253, which is a very slight increase.

• Short sales comprised 1.0% of new listings and 1.2% of sold listings in 2016, each down 1.0% from 2015 respectively as a percentage of the market.

• Bank owned/REO properties comprised 4.0% of new listings and 5.3% of sales in 2016, decreasing 1.6% and 1.3%, respectively, from 2015.

Portland metro when comparing percentage share of the market 2015 to 2016:

• Comparing 2015 to 2016, distressed sales as a percentage of closed sales decreased from 7.4% to 7.3%.

• New listings rose from 40,427 to 40,662, which is a slight increase.

• Short sales comprised 0.9% of new listings and 1.5% of sold listings in 2016, down 1.0% and 0.6% from 2015 respectively as a percentage of the market.

• Bank owned/REO properties comprised 3.0% of new listings and 4.7% of sales in 2016, decreasing 1.8% and 0.6%, respectively, from 2015.

Clark County when comparing percentage share of the market 2015 to 2016:

• Comparing 2015 to 2016, distressed sales as a percentage of closed sales decreased from 8.3% to 4.2%.

• New listings rose from 10,506 to 10,825, which is a slight increase.

• Short sales comprised 1.5% of new listings and 1.6% of sold listings in 2016, down 1.4% and 1.4% from 2015 as a percentage of the market.

• Bank owned/REO properties comprised 2.3% of new listings and 2.6% of sales in 2016, decreasing 1.2% and 2.7% respectively from 2015.

Below are links to additional charts for some of our larger areas:

Portland Metro Area

Clark County, WA

Lane County, OR

Douglas County, OR

Coos County, OR

RMLS™ is pausing its quarterly publication of distressed properties information with the closing of 2016. If distressed properties become a larger portion of residential home sales in the future, distribution of this data may begin again.

If you want information on percentages of distressed sales in other areas not represented by our charts, please contact us at communications@rmls.com.