There’s been some encouraging news lately in the RMLS™ market areas. The number of sales and pending sales are finally outpacing the totals from the same month in 2008. How much of it might be a result of the $8,000 first-time homebuyer tax credit, though?

I recently put together some statistics for the Oregonian on the Portland metro area, and thought I would share them with you.

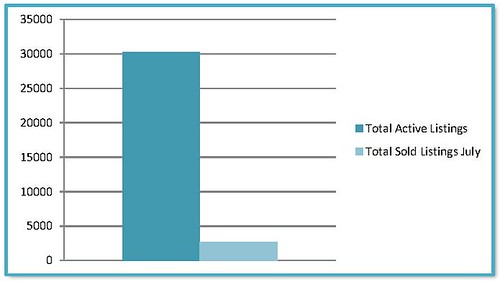

There is no question that home sales in the lower-end of the market have seen a big jump this year. In 2007, homes priced between $0 and $249,999 only made up 35% of all sales in the Portland metro area. In 2009 so far, they make up 49.6% of the market.

As you’d expect, coinciding with the increase in lower-end homes is a drop in high-end homes. Homes priced $500,000 or above have dropped from 13.5% of the market in 2007, to just 8.2% of the market this year.

The question is: what will happen when the $8,000 tax credit expires on December 1?

I know the tax credit definitely got me off the fence & I can literally think of 15 of my friends and acquaintances (off the top of my head) who have bought or are actively looking to buy.

So in my humble opinion, there’s little doubt that the tax credit spurred people to buy. But as the deadline for the credit approaches, it should be interesting to see where sales go.