by RMLS Communication Department | Dec 14, 2009

House Hunters Hit the Pavement After The Holiday

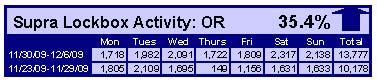

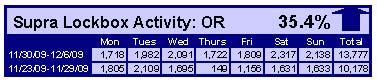

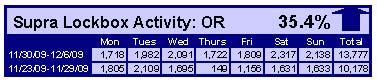

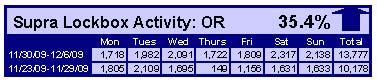

When comparing the week of November 30 through December 6 with the week prior, the number of times an RMLS™ subscriber opened a Supra lockbox increased 32.6% in Washington and 35.4% in Oregon.

Click the chart for a larger view

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Dec 10, 2009

Will new restrictions slow the increase in FHA popularity?

We all know that FHA Loans have increased in the past few years with the changing market, but how much? I recently ran some numbers on financial terms, a required field in RMLSweb, that may shed some light. These numbers are for the Portland metro area (Clackamas, Columbia, Multnomah, Washington and Yamhill counties).

As you can see, sold listings with the financial terms “FHA” have increased in the RMLS Portland market area from just 1.2% in 2007 to 28.1% of sales through October 2009. These numbers are closely in line with national levels; a recent report stated that FHA loans are up to 30% this year from 3% in 2006.

Do you think we’ll continue to see FHA loans grow in popularity, or will it change if plans to make some FHA loans require a down payment higher than 3.5% go through? Realtors, let us know what you’re seeing out in the field – leave a comment below.

by RMLS Communication Department | Dec 7, 2009

House Hunters Take Break for Thanksgiving

When comparing the week of November 23-29 with the week prior, the number of times an RMLS™ subscriber opened a Supra lockbox decreased 24.8% in Washington and 31.7% in Oregon.

Click the chart for a larger view (Oregon, top; Washington, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Nov 20, 2009

21.9% of listings distressed in PDX, 31.7% in Clark County

The latest report from the Mortgage Bankers Association indicated that the rate of foreclosure for people with fixed rate loans and good credit is on the rise.

The AP reports that homeowners’ inability to keep up with payments is now more due to unemployment, rather than the subprime loans that contributed to the initial increase in foreclosures.

A quick search on RMLSweb reveals that in the Portland Metro area, distressed properties currently make up 21.9% of active residential listings (this number takes into account listings that require third-party approval, as this typically indicates a short sale and those that are marked as bank-owned).

In Clark County, 31.7% of residential listings are distressed.

by RMLS Communication Department | Nov 13, 2009

Same-month sales up nearly across the board in Oregon & Southern Washington

Sales activity continued to outpace levels from the same month last year in the latest RMLS™ Market Action report. Inventory was also down in several areas, including Lane County, Portland and Clark County.

Sales Activity:

Both pending and closed sales increased in 9 out of 10 of the regions that we cover when compared to the same month in 2008. The Portland metro area saw its largest increase in closed sales since January 2005 , which was also the highest total of closed sales since August 2007. Clark County set a record for pending sales, with an increase of 56.9% compared to last October. Here’s a recap of each region’s same-month sales activity:

It will be interesting to see if this trend of increased sales activity will continue this fall and winter season. The percentage increases were not surprising this month, given the recent strength in sales and considering that last year we saw sales begin to drop in October, kicking off a stretch of slow sales activity that would extend into the first quarter of 2009.

Inventory:

Housing inventory levels dropped in several key areas, including Lane County (6.2 months), Portland (6.5 months, lowest since August 2007) and Clark County (6.4 months, lowest since September 2006). This is somewhat counterintuitive, as inventory levels have often increased as we head into the slower fall and winter seasons. But, considering the following factors, it’s no surprise:

- Low interest rates

- New listings continue to drop in most areas, reducing the supply of homes available

- The perceived tax credit deadline (which has since been extended)

- Lower home prices

What do you think?

Realtors – what do you think? Where do you see the market heading? Have you heard increased interest from buyers and sellers since the tax credit extension/expansion? Comment below!

by RMLS Communication Department | Oct 26, 2009

Down 5.5% in Washington and Oregon

When comparing the week of October 12 – 18 with the week prior, the number of times an RMLS™ subscriber opened a Supra lockbox decreased 5.5% in Washington and Oregon.

Click the chart for a larger view (Washington, top; Oregon, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.