by RMLS Communication Department | Aug 4, 2009

Our friends over at

Oregon Real Estate Forms (OREF) have issued the following update about the disclosure of Annual Percentage Rate:

OREF’s legal counsel, Phil Querin, advises all brokers in the state of Oregon to be aware of federal disclosure requirement that may cause a delay in closing.

Under new rules enacted by the Federal Reserve Board Truth in Lending Act, effective July 30, 2009 it is required that if the final Annual Percentage Rate (APR) changes by .125% or more as disclosed in the Good Faith Estimate there is a mandatory additional three business day waiting period before the transaction can close.

It is suggested that brokers get their buyers and sellers to agree in advance to a written extension as a contingency if the final APR causes the 3-day extension beyond the scheduled Closing Deadline such as:

“In the event that Buyer’s final Annual Percentage Rate (“APR”) differs from the APR initially disclosed to the Buyer in the Good Faith Estimate by .125% or more, the Closing Deadline defined in the Real Estate Sale Agreement shall automatically be extended for three (3) additional business days in accordance with Regulation Z of the Truth in Lending Act, as amended on July 30, 2008.”

If brokers encounter such a situation for a transaction already in process, they can extend the Closing Deadline by using an addendum form (OREF-002).

Caveat: This is not legal advice. All brokers should confer with their principal brokers and also recommend that their clients consult their own legal counsel if they have any questions.

by RMLS Communication Department | Jul 31, 2009

With all the stories in the media, it seems like everyone is facing foreclosure these days. (Even Michael Jackson’s doctor.) So I thought it would be interesting to look at the foreclosure market in our service area to find out what’s really going on.

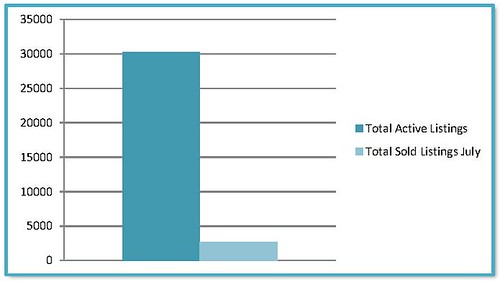

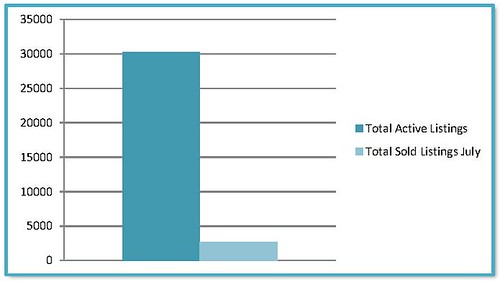

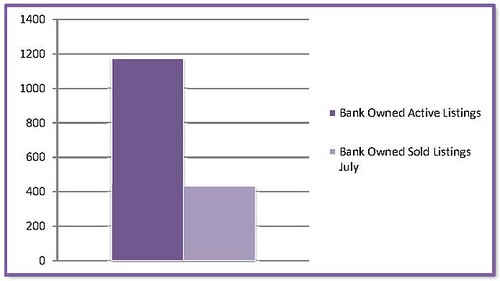

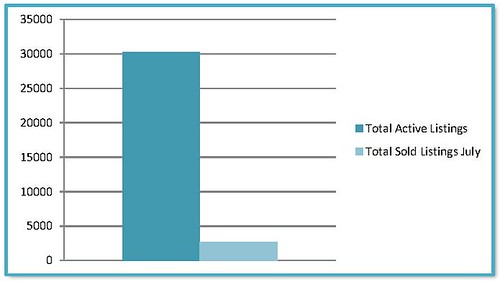

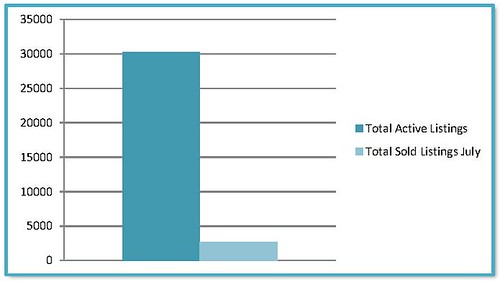

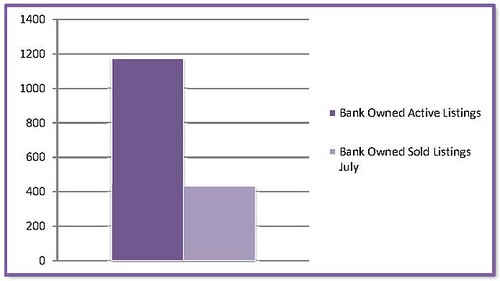

We currently have 30,276 active residential listings in RMLSweb–this includes Oregon and Washington. Of those, 1,172 are marked as Bank Owned. That’s approximately 3.9%.

Out of curiosity, I took my research a little further to find out how well Bank Owned properties are selling versus the entire inventory in our markets. So far in July 2009, 2,707 properties in our entire database sold. According to my research, 430 of them were marked Bank Owned.

If we didn’t add any more listings of any kind to RMLSweb and the active residential properties kept selling at the same rate they did in July it would take 11.2 months to sell our entire inventory and only 2.7 months to exhaust the inventory of Bank Owned Properties.

Granted, it’s only the morning of the last day of July so it’s likely that we’ll see the numbers of sales go up over the next few days, but this should give you a snapshot of what’s going on with Bank Owned properties.

by RMLS Communication Department | Jul 29, 2009

Here’s a few hot weather tips I came up with for real estate agents as we all cope with a potential high of

107 today here in Portland!

1. If buyers close on 100+ degree day, offer a window A/C unit as a closing gift (good luck finding one right now, though).

2. Selling agents: if your listing has A/C or is A/C ready – make sure you’re showing those houses now! The heat should really make that selling point stick in the buyer’s mind (and their shirt stick to their back).

3. Keep a cooler full of water bottles for your clients in your trunk when showing homes.

4. Always offer to purchase a Slurpee for your clients.

5. If you happen to be rolling in a convertible while showing homes – apply sunscreen between 10 a.m. and 3 p.m., or put the top up.

PS: If you use an ActiveKEY, make sure not to leave it in a hot car for long:

[youtube=http://www.youtube.com/watch?v=h-fdVTBBiCM]

by RMLS Communication Department | Jul 27, 2009

The State of Oregon Real Estate Agency has issued the following alert on its website:

The Agency is receiving calls from licensees asking if their fingerprint cards have expired. The licensees explain that someone stating to be from the Agency has called them and informed them that their fingerprints are going to expire. The caller is asking for credit card and social security numbers.

Fingerprint cards and criminal background checks do not expire with the Agency. Also the Agency does not accept any personal or confidential information over the phone. If you receive one of these calls, do not give your information out.

by RMLS Communication Department | Jul 27, 2009

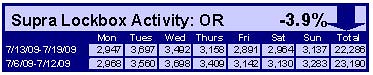

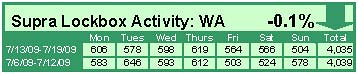

Activity down over previous week

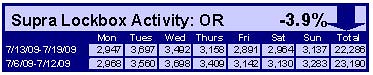

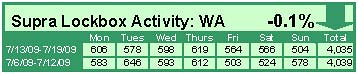

Comparing July 6, 2009 through July 19, 2009 the number of times RMLS™ subscribers opened Supra lockboxes decreased 0.1% in Washington and 3.9% in Oregon.

Click the chart for a larger view (Oregon, left; Washington, right)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

by RMLS Communication Department | Jul 16, 2009

The latest issue of the RMLS™ Market Action for June 2009 shows increases in accepted offers, closed sales and a decrease in inventory in several regions.

Accepted Offers

The five county Portland Metro Area saw a month-over-month increase in pending sales (8.4% comparing June 2009 with June 2008) for the first time since December 2006. Pending sales also increased for the third month in a row in Clark County, Washington. The following regions also saw an increase in pending listings in June 2009: Coos, Curry, Douglas, Lane, Mid-Columbia and Union.

Closed Sales

Closed sales in Clark County increased14.8% comparing June 2009 with June 2008. This is the first increase since September 2008.

The following regions also experienced increases in closed sales: Columbia Basin, Curry, Douglas and Mid-Columbia.

Inventory

Inventory in all three of our largest service areas (Portland Metro, Clark County and Lane County) dipped to the lowest it’s been since August 2007. In addition, the following counties experienced drops in inventory from the previous month: Columbia Basin, Coos, Curry and Douglas.