by RMLS Communication Department | Jan 14, 2010

Real estate activity in Oregon and SW Washington up in most RMLS areas

In the December 2009 RMLS™ Market Action report, sales activity was up in most areas that we cover, compared to December 2008. Though this is a positive sign, it should be taken with a grain of salt, because last December brought record lows for pending and closed sales in many areas.

Portland saw a 52.6% increase in closed sales this month and a 40.9% increase in pending listings, while Clark County closed sales were up 48.1%, and pending sales rose 33.8%. Baker County, Coos County, Curry County, Lane County, the Mid-Columbia region and Union County also saw both closed and pending sales increase over last December.

Sales volume down for the year in most areas

Given lower sales totals and lower prices, this should come as no surprise, but total sales volume for the year fell in most areas in 2009. Portland dropped from $6.3 billion in 2008 to $5.5 billion this year. Lane County was down from $740 million in 2008 to $669 million in 2009.

Notable, however, is an increase in sales volume in Curry County – up to $66 million this year from $59 million in 2008. And Clark County matched its total sales volume of $1.2 billion in 2008.

Year-end stats, Clark County shines

Clark County seems to be ahead of the pack when it comes to sales activity. For the year, pending sales were up 19.5% and closed sales up 13.8% compared to 2008. That’s far ahead of most areas; for example, in Portland, pending sales were up 4%, and closed sales were down 0.9%. Only Curry County outpaced Clark County in percentage of sales increase for 2009, with pending sales up 31.3% and closed sales up 23.7%.

However, the increase in sales has come at a price – Clark County saw the largest decrease (-12.6%) in median sale price for the 11 areas we cover.

by RMLS Communication Department | Oct 16, 2009

Residential real estate sales tick up in several areas, inventory down

This month’s RMLS™ Market Action report showed a trend of increasing real estate sales & subsequently lower housing inventory in many areas of Oregon & Southwest Washington.

Sales Activity:

Closed sales rose in the following areas this month, compared to the same month in 2008:

| Area |

Closed Sales |

| Curry County, Oregon |

100% |

| Columbia Basin, Oregon |

36.6% |

| Lane County, Oregon |

23.2% |

| Clark County, Washington |

20.2% |

| Portland Metro, Oregon |

9.8% |

Third Quarter Sales Up:

September marked the end of the third quarter and compared to Q3 in 2008, Coos County, Curry County, Douglas County, Lane County, Portland and Clark County all saw sales outpace Q3 in 2008. Clark County led the pack at a clip of 18.7%.

Inventory:

Ten of eleven areas that we cover in the Market Action report saw housing inventory drop from August. This can be attributed to rising sales in several areas and as we head into the slower fall & winter seasons, fewer homes are being listed as well.

Both the Portland and Clark County areas saw inventory drop to 7.6 months. Lane County has the lowest inventory of the areas we cover at 6.8 months.

by RMLS Communication Department | Aug 13, 2009

We released the latest Market Action reports to RMLS™ subscribers yesterday. Many areas of Oregon and Southwest Washington are showing improvement as far as sales and inventory go – here are a few highlights:

Portland Metro Active Listings: Note how the 2009 line is basically flat.

Inventory: Inventory is showing steady improvement in Portland (7.3 months), Clark County (7.3 months), and Lane County (6.2 months). In most circles, 6 months of supply is considered a balanced market. The drop in inventory comes thanks to strong closed sales, but also because the number of active listings is growing at a much slower pace than usual.

Closed sales: The Portland metro area was finally able to post a gain in same-month closed sales for the first time since April 2007. Closed sales were up 8.6% compared to last July. Clark County posted a gain for the second straight month – closed sales were up 23.5% there. Lane County also posted an 11% gain. Baker County, Curry County, Douglas County, and the Mid-Columbia region also saw growth.

Clark Co. Pending Sales: Oh, so close to reaching July 2007 levels.

Pending sales: Same-month pending sales in Clark County grew for the fourth month in a row at 30.3%. In fact, Clark County pending sales not only surpassed July 2008 levels, but they came close to hitting July 2007 levels. With the exception of the Mid-Columbia region and Union County, same-month pending sales grew in all of our primary service areas.

by RMLS Communication Department | Jul 27, 2009

Short video shows why RMLS™ subscribers should keep their ActiveKEYs out of the heat this week

We’re going to have some serious heat in most of Oregon & Southwest Washington this week. As you try to stay cool in the hot weather, keep in mind this friendly ActiveKEY battery tip from Supra:

“Temperature extremes can affect battery performance. If the ActiveKEY is below 0° C (32° F) or above 40 ° C (104° F), it will not charge. During very cold or hot times of the year, bring your ActiveKEY in from your car at night and between showings.”

Also, watch this short video that poses the question – what happens when you leave an ActiveKEY, a frozen pizza and a frozen peanut butter cup in my 1997 Geo Metro that is parked in direct sunlight?

[youtube=http://www.youtube.com/watch?v=h-fdVTBBiCM]

We filmed this a few weeks ago when it was up to about 94 degrees, so keep in mind that you might see more dramatic results in the next few days. Anyone have any other suggestions for things we should try to melt in my car?

PS: We really do recommend that you remove your key from your car if it’s going to be parked in the sun for a long time – especially for agents that go to our Portland office – because we currently have a limited supply of ActiveKEYs due to a parts shortage at Supra. If you do need to get a new ActiveKEY, please call ahead at 503-236-7657 to ensure that we have one available for you.

by RMLS Communication Department | Jun 18, 2009

One of the most interesting statistics I saw in the latest issues of Market Action was the increase of pending sales compared to May 2008 in Clark County. This was the second month in a row that the number of pending sales rivaled that of the same time period a year ago. This is good news! But what caught me by surprise was that the number of closed sales is still down from the same time a year ago.

So I started to wonder:

1) On average how long does it take for pending listings to show up as sold? According to the National Association of Realtors® pending home sales typically “become existing-home sales one-to-two months later.”

2) What percentage of accepted offers fail these days? Using a formula that I got from my new friend Chuck Reiling, a real estate professional in Seattle, WA, I took a stab at calculating the fallouts for properties in Clark County.

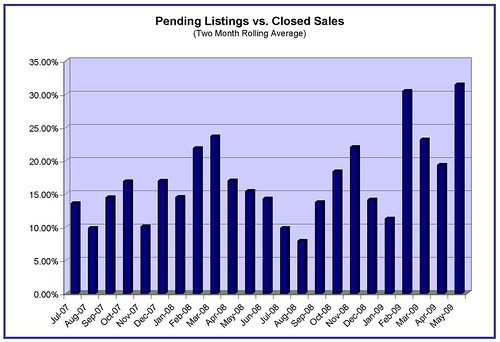

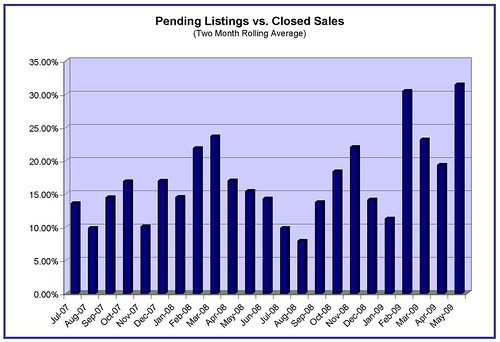

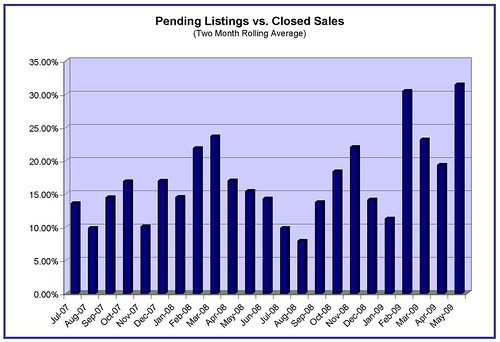

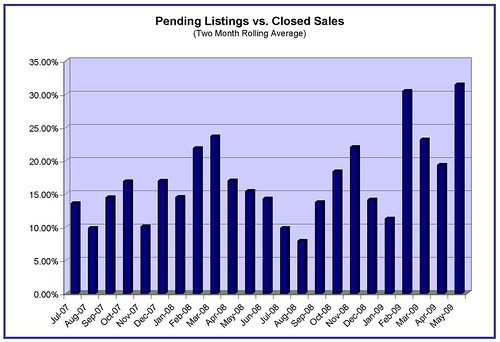

Following Chuck’s formula I looked at the pending listings monthly from May 1, 2007 to May 31, 2009 and the closed sales from June 1, 2007 to May 31, 2009. Like Chuck I staggered the pendings by one month to allow for a “typical” close time and I used a two month running average to adjust for variances.

Here’s a graph of the ratios:

The average pending vs. closed sale ratio is 17 percent. You’ll notice that the last few months have all been above that rate, with May 2009 coming in at 31.4 percent (the highest so far).

According to Eric Newman, a Mortgage Banker with Summit Mortgage Corp, these numbers may not actually reflect sale fails, but rather sale delays. Newman says that these days there are a number of factors that increase closing time, from waiting on bank approval when needed (approximate average of three weeks) to overwhelmed underwriters (current response time for FHA loans is around 21 days).

For example, I did a quick search in RMLSweb and discovered that out of the 552 properties that went pending in Clark County in April, approximately 117 were marked as requiring 3rd party approval (not all of these listings are short sales, but most of them are) and 122 were listed as bank owned. That’s almost half of the pending listings – 43 percent.

While it’s likely that a percentage of these more complicated transactions do fail, it also may be that these listings take longer to close so the typical one month lag may not apply. Newman says we would expect that most of those pending listings will probably not be recorded as closed until June because many loans are taking 45 to 60 days to close in the current market.

What do you think? What are you seeing out in the field?