The Rules Roundup provides a monthly accounting of RMLS rules violations and courtesy notifications. Our Data Accuracy team manages all reports of property listing errors, tracking 34 specific issues outlined in the RMLS Rules and Regulations, and is responsible for addressing subscriber questions and concerns regarding listing accuracy.

HIGHLIGHTS

Our listing checker and violation software have received technological upgrades as part of our data feed move to a RESO-compliant Web API. As a result, a few changes have been made to the system and settings.

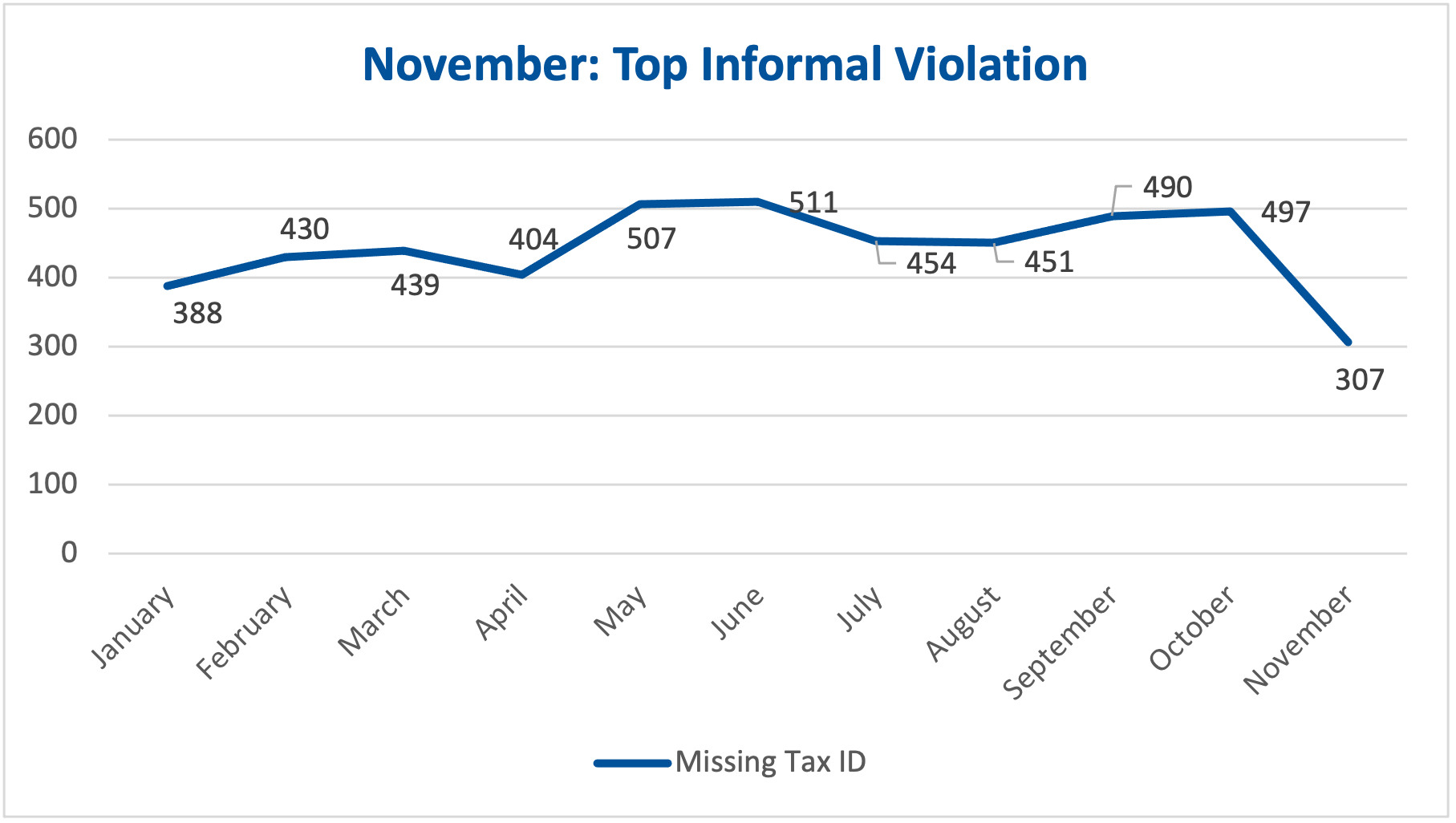

Missing Tax ID Violations: This type of violation will now exclude “proposed” and “Under Construction” property conditions, meaning that these property conditions will no longer receive a Missing Tax ID violation unnecessarily. This will also cause the stats for that violation to decrease significantly, as reflected in the November statistical data.

Artificial Intelligence: We’ve recently incorporated Restb.ai, which uses artificial intelligence to evaluate the metadata in property photos, into our process to check all uploaded photos for violations. This will add new statistical data on violations and greatly improve our reach and accuracy regarding photo violations.

The software is set up to look for violations regarding the first photo, personal promotion, people, unauthorized text, and unauthorized watermarks. This data will begin to be reflected in the December statistics.

FORMAL VIOLATIONS

The RMLS Rules and Regulations Committee reviews all formal complaints which allege a violation of the RMLS Rules and Regulations. The committee has the power to impose sanctions.

There were two formal violation cases in November. Both cases concerned the unauthorized use of a lockbox (rule 3.22 from the RMLS Rules and Regulations), with one case resulting in a fine of $250 and other resulting in a $500 fine with a mandatory SentriLock rules class.

INFORMAL VIOLATIONS

Listings missing Tax ID information are consistently the top informal violation within RMLSweb. Sometimes the missing tax information is due to an error of omission. Other times, it may be because the listing is a new construction property that does not yet have a tax ID number available. Data Accuracy sends courtesy notices out to remind agents of the need to provide the tax information (when available).

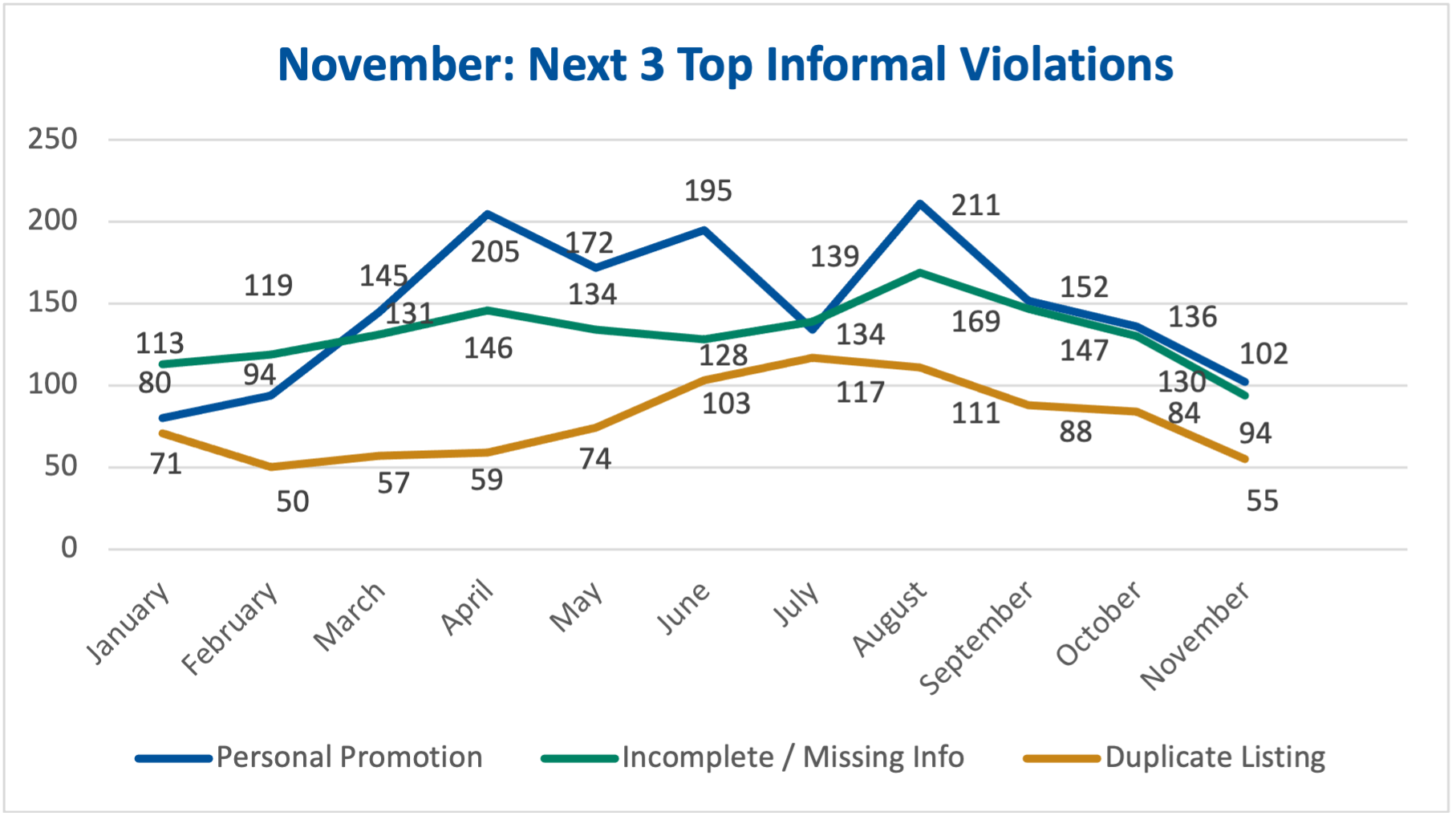

The chart below shows the next three most frequent informal violations from November 2022.

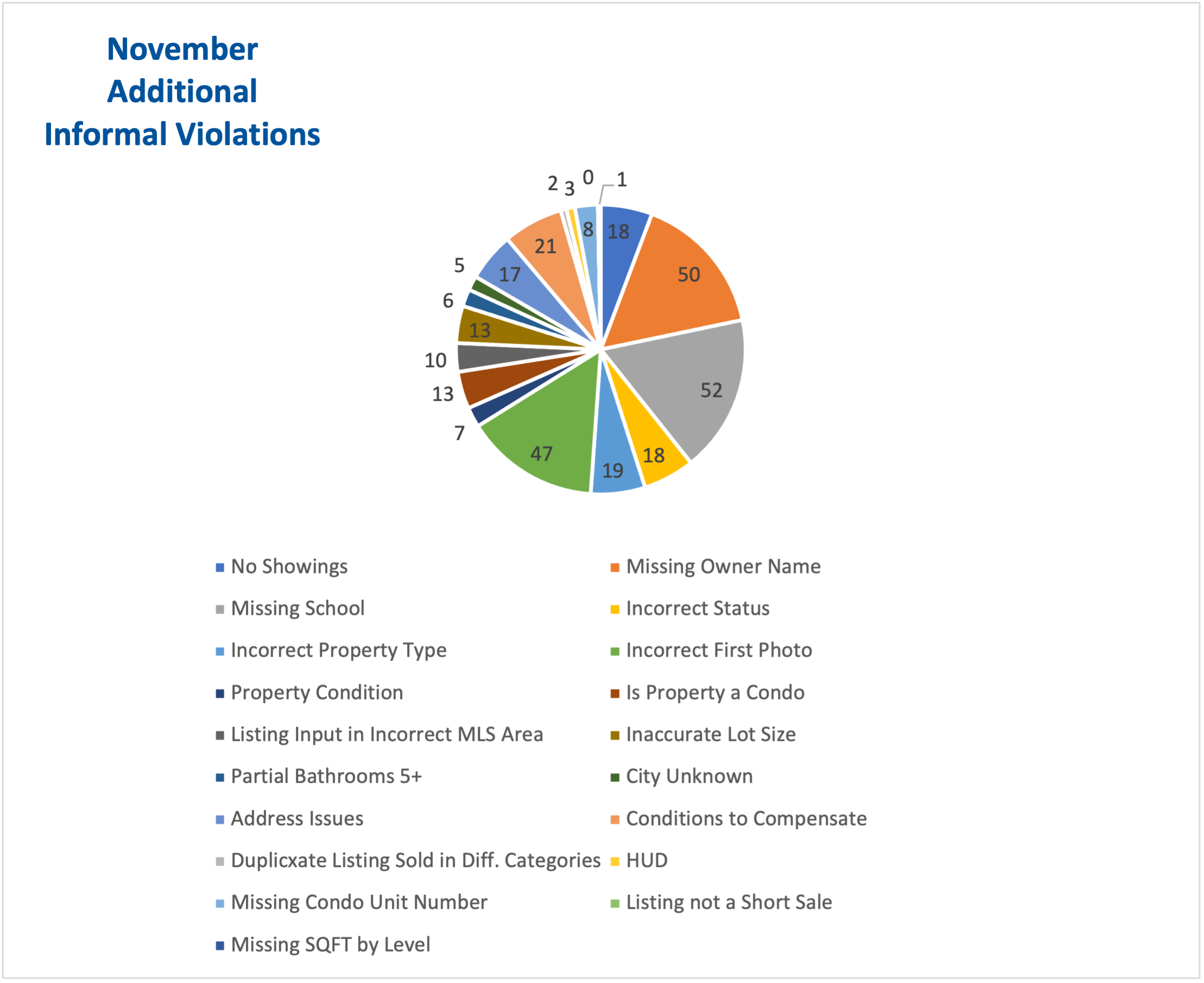

This pie chart shows the remainder of the informal violations last month.

Data Accuracy Department Statistics

- Listings Reviewed: 9,969

- Notices Sent: 1,853

- Violation Notices Received: 280

- Courtesy Notices Sent: 1,327

- Phone Calls Received: 380

How to Report Violations

Subscribers have multiple options to report violations, including a Report Issue button on every RMLSweb listing. Subscribers can email our Data Accuracy team at dataaccuracy@rmls.com or call them at 503.395.1916. When there are increases in specific violation types, we sometimes place notifications on RMLSweb.