![Supra Lockbox Activity January 14-20, 2013]()

by RMLS Communication Department | Jan 28, 2013

This Week’s Lockbox Activity

This Week’s Lockbox Activity

For the week of January 14-20, 2013, these charts show the number of times RMLS™ subscribers opened Supra lockboxes in Oregon and Washington. The numbers in Oregon and Washington rose slightly this week.

For a larger version of each chart, visit the RMLS™ photostream on Flickr.

![Supra Lockbox Activity January 14-20, 2013]()

by RMLS Communication Department | Jan 25, 2013

Each month, RMLS™ takes RMLSweb offline for a few hours in order to perform system maintenance and make improvements to the system. In January, RMLS™ will be implementing several small features designed to improve the site for subscribers.

Unauthorized Access

RMLS™ is embarking on a project this month designed to eliminate unauthorized access of RMLSweb. We will begin reviewing accounts which have a history of excessive duplicate logins and/or logins from multiple geographic locations (within a short timeframe) and work with those users to ensure the security of RMLSweb.

The program is designed to reduce potential security risks for both RMLS™ and our subscribers and also to improve user experience. We’d like every user to enjoy their RMLSweb sessions the way they were designed to work.

Rules Button

Rules Button

A new button will appear on RMLSweb‘s Agent Full and Data Only reports beginning January 31st that will enable subscribers to more easily submit concerns about a listing’s information to RMLS™ staff. Clicking the “Report an Issue” button below each listing on those reports will produce a pop-up window with a report subscribers can fill out and submit to the RMLS™ Rules and Regulations Department.

School Names

RMLSweb will update school names using proper case (Dundee vs. DUNDEE) and spell out most abbreviations (Falcon Heights vs. FALCON HTS). This will involve updating RMLSweb search fields and saved searches as well.

Increased Prospect Notifications

RMLSweb subscribers may currently receive notification of a prospect match up to three times a day. Starting January 31st, that frequency will be increased significantly, matching REALTORS® with prospective properties up to eight times throughout the day. As is currently the case, until the subscriber logs into RMLSweb to clear the matche(s), additional prospect notifications will not be sent.

SSP As Default on Search

SSP As Default on Search

Currently, RMLSweb defaults to including Short Sale Pending (SSP) in default search parameters. The RMLS™ Board of Directors has requested this default be removed. Beginning January 31st, only ACT and BMP will remain as default statuses, and subscribers will need to select SSP if they wish to search those listings.

We hope subscribers find these tweaks to RMLSweb useful. If you have any questions regarding these changes, email Help Desk at helpdesk@rmls.com or call us at (503) 872-8002, or outside the Portland area at (877) 256-2169.

![Supra Lockbox Activity January 14-20, 2013]()

by RMLS Communication Department | Jan 24, 2013

The chart below shows the number of bank owned/REO and short sales in all areas of the RMLS™ system during 2012.

All areas when comparing percentage share of the market 2011 to 2012:

• Comparing 2011 to 2012, distressed sales as a percentage of closed sales decreased from 33.5% to 28.6%.

• New listings dropped from 61,980 to 58,280 which is a 5.9% decrease.

• Short sales comprised 11.3% of new listings and 12.1% of sold listings in 2012, down 2.6% and up 1.4% from 2011 respectively as a percentage of the market.

• Bank owned properties comprised 10.3% of new listings and 16.5% of sales in 2012, decreasing slightly from 13.1% and 22.8% respectively in 2011.

Portland metro when comparing percentage share of the market 2011 to 2012:

• Comparing 2011 to 2012, distressed sales as a percentage of closed sales decreased from 33.1% to 28.2%.

• New listings dropped from 33,940 to 32,011 which is a 5.6% decrease.

• Short sales comprised 12.1% of new listings and 12.3% of sold listings in 2012, down 3.2% and up 1.5% from 2011 respectively as a percentage of the market.

• Bank owned properties comprised 10.4% of new listings and 15.9% of sales in 2012, decreasing slightly from 13.4% and 22.3% respectively in 2011.

Clark County when comparing percentage share of the market 2011 to 2012:

• Comparing 2011 to 2012, distressed sales as a percentage of closed sales decreased from 43.2% to 32.2%.

• New listings dropped from 8,643 to 7,280 which is a 15.7% decrease.

• Short sales comprised 19.1% of new listings and 18.5% of sold listings in 2012, down 1.9% and up 2.1% from 2011 respectively as a percentage of the market.

• Bank owned properties comprised 8.8% of new listings and 13.7% of sales in 2012, decreasing from 15.9% and 26.8% respectively in 2011.

Below are links to additional charts for some of our larger areas:

Portland Metro

Clark County, WA

Lane County, OR

Douglas County, OR

Coos County, OR

If you want information on percentages of distressed sales in other areas not represented by our charts, please contact us at communications@rmls.com.

![Supra Lockbox Activity January 14-20, 2013]()

by RMLS Communication Department | Jan 21, 2013

This Week’s Lockbox Activity

This Week’s Lockbox Activity

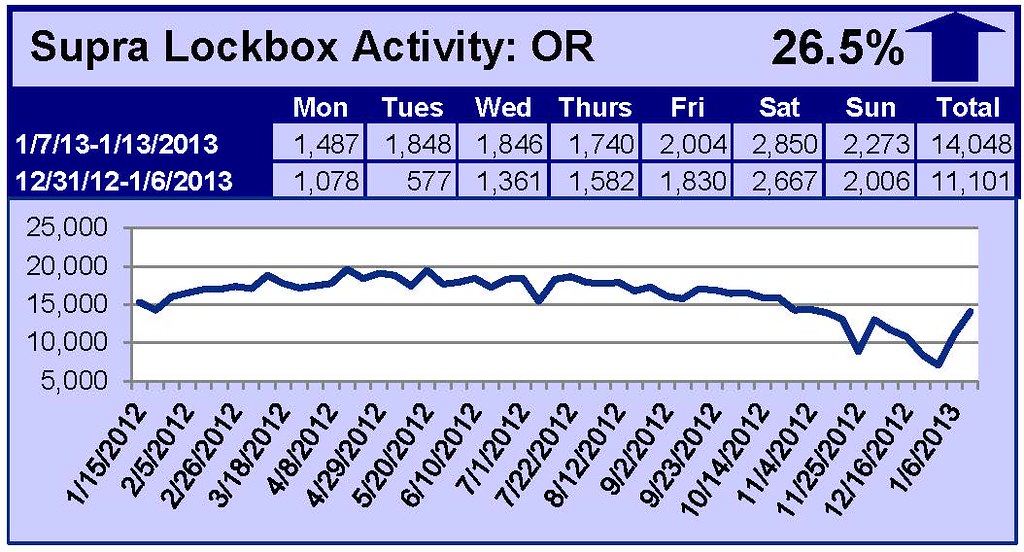

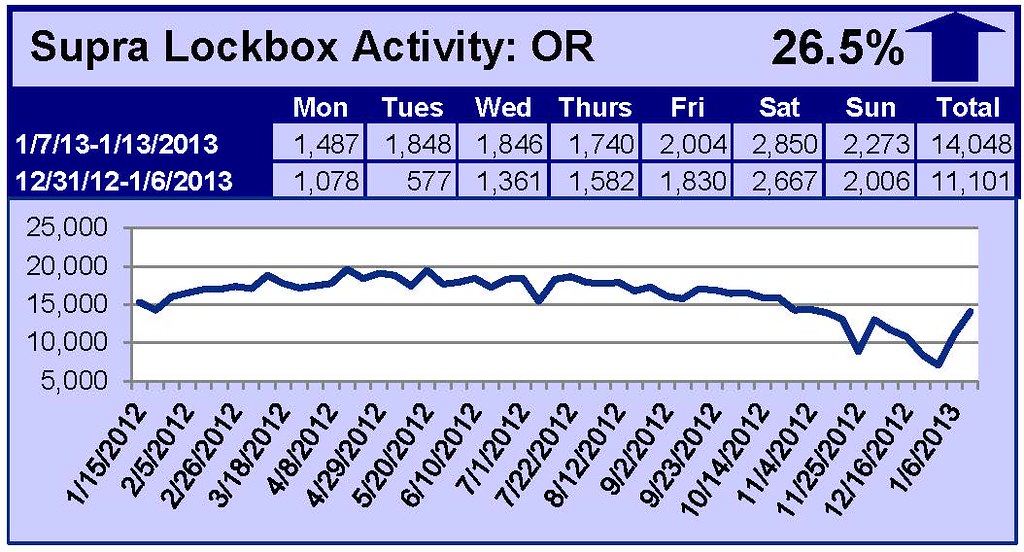

For the week of January 7-13, 2013, these charts show the number of times RMLS™ subscribers opened Supra lockboxes in Oregon and Washington. The numbers in Oregon and Washington kept rising this week.

For a larger version of each chart, visit the RMLS™ photostream on Flickr.

![Supra Lockbox Activity January 14-20, 2013]()

by RMLS Communication Department | Jan 18, 2013

This chart shows the number of bank owned properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2012.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (4th Quarter 2012)

• Clark County, WA Distressed Properties (4th Quarter 2012)

• Lane County, OR Distressed Properties (4th Quarter 2012)

• Douglas County, OR Distressed Properties (4th Quarter 2012)

• Coos County, OR Distressed Properties (4th Quarter 2012)

Here are some additional facts about distressed residential properties in the fourth quarter of 2012:

All areas when comparing percentage share of the market, fourth quarter 2012 to third quarter 2012:

• When comparing the fourth quarter of 2012 to the third quarter, distressed sales as a percentage of new listings increased by 3.2% (21.4% v. 18.2%).

• In a comparison of the fourth quarter of 2012 to the third quarter, distressed sales as a percentage of closed sales decreased by 1.2% (23.6% v. 24.8%).

• Short sales comprised 11.3% of new listings and 11.9% of sales in the fourth quarter of 2012, up 1.5% and down .3% from the third quarter of 2012, respectively.

• Bank owned/REO properties comprised 10.1% of new listings and 11.7% of sales in the fourth quarter of 2012, up 1.7% and down .9% from the third quarter of 2012, respectively.

Portland Metro when comparing percentage share of the market, fourth quarter 2012 to third quarter 2012:

• When comparing the fourth quarter of 2012 to the third quarter, distressed sales as a percentage of new listings increased by 2.6% (21.1% v. 18.5%).

• In a comparison of fourth quarter 2012 to third quarter, distressed sales as a percentage of closed sales decreased by 1.4% (22.8% v. 24.2%).

• Short sales comprised 12.0% of new listings and 12.3% of sales in the fourth quarter of 2012, up 1.8% and down .2% from the third quarter of 2012, respectively.

• Bank owned/REO properties comprised 9.1% of new listings and 10.5% of sales in the fourth quarter of 2012, up .8% and down 1.2% from the third quarter of 2012, respectively.

Clark County when comparing percentage share of the market, fourth quarter 2012 to third quarter 2012:

• When comparing the fourth quarter of 2012 to the third quarter, distressed sales as a percentage of new listings increased by 2.1% (26.7% v. 24.6%).

• In a comparison of fourth quarter 2012 to third quarter 2012, distressed sales as a percentage of closed sales decreased by 1.0% (28.8% v. 29.8%).

• Short sales comprised 17.8% of new listings and 18.6% of sales in the fourth quarter of 2012, up .6% for new listings and down 1.5% for sales when compared to the third quarter of 2012, respectively.

• Bank owned/REO properties comprised 8.9% of new listings and 10.2% of sales in the fourth quarter of 2012, up 1.5% and .5% from the third quarter of 2012, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.