![Residential Distressed Properties for First Quarter (January-March) 2015]()

by RMLS Communication Department | Apr 16, 2015

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the first quarter of 2015.

Below are links to additional charts for some of our larger areas.

• Portland Metro Area Distressed Properties (1st Quarter 2015)

• Clark County, WA Distressed Properties (1st Quarter 2015)

• Lane County, OR Distressed Properties (1st Quarter 2015)

• Douglas County, OR Distressed Properties (1st Quarter 2015)

• Coos County, OR Distressed Properties (1st Quarter 2015)

Here are some additional facts about distressed residential properties in the first quarter of 2015:

All areas when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.1% (8.9 v. 12.0%).

• In a comparison of the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 2.8% (12.3 v. 9.5%).

• Short sales comprised 2.9% of new listings and 3.4% of sales in the first quarter of 2015, down 0.6% and up 0.4% from the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 6.0% of new listings and 8.9% of sales in the first quarter of 2015, down 2.5% and up 2.4% from the fourth quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.0% (7.7 v. 10.7%).

• In a comparison of first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 1.9% (10.1 v. 8.2%).

• Short sales comprised 2.8% of new listings and 3.0% of sales in the first quarter of 2015, down 1.0% and up 0.1% from the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.9% of new listings and 7.1% of sales in the first quarter of 2015, down 2.0% and up 1.8% from the fourth quarter of 2014, respectively.

Clark County when comparing percentage share of the market, first quarter 2015 to fourth quarter 2014:

• When comparing the first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of new listings decreased by 3.4% (9.3 v. 12.7%).

• In a comparison of first quarter 2015 to fourth quarter 2014, distressed sales as a percentage of closed sales increased by 2.5% (14.0 v. 11.5%).

• Short sales comprised 4.4% of new listings and 5.0% of sales in the first quarter of 2015, staying even for new listings and up 0.7% for sales when compared to the fourth quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.9% of new listings and 9.0% of sales in the first quarter of 2015, down 3.4% and up 1.8% from the fourth quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

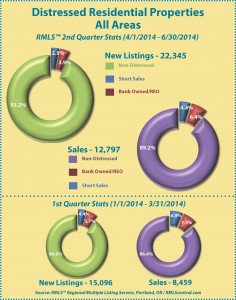

![Residential Distressed Properties for First Quarter (January-March) 2015]()

by RMLS Communication Department | Jan 20, 2015

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the fourth quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Area Distressed Properties (4th Quarter 2014)

• Clark County, WA Distressed Properties (4th Quarter 2014)

• Lane County, OR Distressed Properties (4th Quarter 2014)

• Douglas County, OR Distressed Properties (4th Quarter 2014)

• Coos County, OR Distressed Properties (4th Quarter 2014)

Here are some additional facts about distressed residential properties in the fourth quarter of 2014:

All areas when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.9% (12.0 v. 7.1%).

• In a comparison of the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.7% (9.5 v. 8.8%).

• Short sales comprised 3.5% of new listings and 3.0% of sales in the fourth quarter of 2014, up 0.9% and down 0.3% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.5% of new listings and 6.5% of sales in the fourth quarter of 2014, up 4.0% and 1.0% from the third quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 4.5% (10.7 v. 6.2%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 1.0% (8.2 v. 7.2%).

• Short sales comprised 3.8% of new listings and 2.9% of sales in the fourth quarter of 2014, up 1.2% and down 0.4% from the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 6.9% of new listings and 5.3% of sales in the fourth quarter of 2014, up 3.3% and 1.4% from the third quarter of 2014, respectively.

Clark County when comparing percentage share of the market, fourth quarter 2014 to third quarter 2014:

• When comparing the fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of new listings increased by 3.9% (12.7 v. 8.8%).

• In a comparison of fourth quarter 2014 to third quarter 2014, distressed sales as a percentage of closed sales increased by 0.4% (11.5 v. 11.1%).

• Short sales comprised 4.4% of new listings and 4.3% of sales in the fourth quarter of 2014, up 0.6% for new listings and down 0.4% for sales when compared to the third quarter of 2014, respectively.

• Bank owned/REO properties comprised 8.3% of new listings and 7.2% of sales in the fourth quarter of 2014, up 3.3% and 0.8% from the third quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

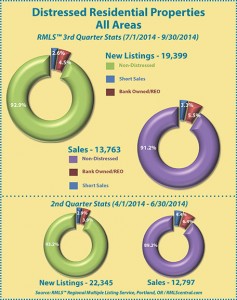

![Residential Distressed Properties for First Quarter (January-March) 2015]()

by RMLS Communication Department | Oct 16, 2014

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the third quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (3rd Quarter 2014)

• Clark County, WA Distressed Properties (3rd Quarter 2014)

• Lane County, OR Distressed Properties (3rd Quarter 2014)

• Douglas County, OR Distressed Properties (3rd Quarter 2014)

• Coos County, OR Distressed Properties (3rd Quarter 2014)

Here are some additional facts about distressed residential properties in the third quarter of 2014:

All areas when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.3% (7.1 v. 6.8%).

• In a comparison of the third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 2.0% (8.8 vs. 10.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.3% and 1.1% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.5% of new listings and 5.5% of sales in the third quarter of 2014, up 0.6% and down 0.9% from the second quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings increased by 0.1% (6.2 vs. 6.1%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 1.6% (7.2 v. 8.8%).

• Short sales comprised 2.6% of new listings and 3.3% of sales in the third quarter of 2014, down 0.4% and 0.8% from the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.6% of new listings and 3.9% of sales in the third quarter of 2014, up 0.5% and down 0.8% from the second quarter of 2014, respectively.

Clark County when comparing percentage share of the market, third quarter 2014 to second quarter 2014:

• When comparing the third quarter 2014 to second quarter 2014, distressed sales as a percentage of new listings decreased by 0.6% (8.8 v. 9.4%).

• In a comparison of third quarter 2014 to second quarter 2014, distressed sales as a percentage of closed sales decreased by 4.7% (11.1 v. 15.8%).

• Short sales comprised 3.8% of new listings and 4.7% of sales in the third quarter of 2014, down 0.9% for new listings and 2.0% for sales when compared to the second quarter of 2014, respectively.

• Bank owned/REO properties comprised 5.0% of new listings and 6.4% of sales in the third quarter of 2014, up 0.3% and down 2.7% from the second quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

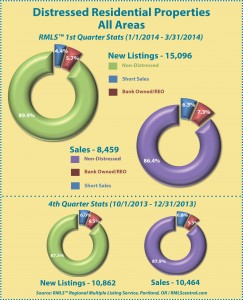

![Residential Distressed Properties for First Quarter (January-March) 2015]()

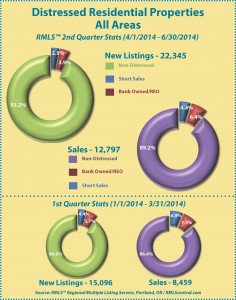

by RMLS Communication Department | Jul 16, 2014

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the second quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (2nd Quarter 2014)

• Clark County, WA Distressed Properties (2nd Quarter 2014)

• Lane County, OR Distressed Properties (2nd Quarter 2014)

• Douglas County, OR Distressed Properties (2nd Quarter 2014)

• Coos County, OR Distressed Properties (2nd Quarter 2014)

Here are some additional facts about distressed residential properties in the second quarter of 2014:

All areas when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.3% (6.8 v. 10.1%).

• In a comparison of the second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.8% (10.8 v. 13.6%).

• Short sales comprised 2.9% of new listings and 4.4% of sales in the second quarter of 2014, down 1.5% and 1.9% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.9% of new listings and 6.4% of sales in the second quarter of 2014, down 1.8% and 0.9% from the first quarter of 2014, respectively.

Portland metro when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 2.8% (6.1 v. 8.9%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 2.2% (8.8 v. 11.0%).

• Short sales comprised 3.0% of new listings and 4.1% of sales in the second quarter of 2014, down 1.3% and 2.0% from the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 3.1% of new listings and 4.7% of sales in the second quarter of 2014, down 1.5% and 0.2% from the first quarter of 2014, respectively.

Clark County when comparing percentage share of the market, second quarter 2014 to first quarter 2014:

• When comparing the second quarter 2014 to first quarter 2014, distressed sales as a percentage of new listings decreased by 3.1% (9.4 v. 12.5%).

• In a comparison of second quarter 2014 to first quarter 2014, distressed sales as a percentage of closed sales decreased by 7.3% (15.8 v. 23.1%).

• Short sales comprised 4.7% of new listings and 6.7% of sales in the second quarter of 2014, down 1.2% for new listings and 4.2% for sales when compared to the first quarter of 2014, respectively.

• Bank owned/REO properties comprised 4.7% of new listings and 9.1% of sales in the second quarter of 2014, down 1.9% and 3.1% from the first quarter of 2014, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

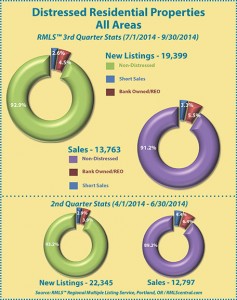

![Residential Distressed Properties for First Quarter (January-March) 2015]()

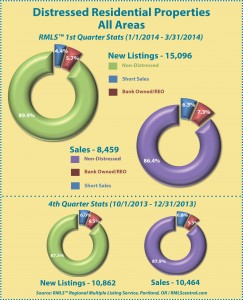

by RMLS Communication Department | Apr 17, 2014

This chart shows the number of bank owned/REO properties and short sales in all areas of the RMLS™ system during the first quarter of 2014.

Below are links to additional charts for some of our larger areas.

• Portland Metro Distressed Properties (1st Quarter 2014)

• Clark County, WA Distressed Properties (1st Quarter 2014)

• Lane County, OR Distressed Properties (1st Quarter 2014)

• Douglas County, OR Distressed Properties (1st Quarter 2014)

• Coos County, OR Distressed Properties (1st Quarter 2014)

Here are some additional facts about distressed residential properties in the first quarter of 2014:

All areas when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 2.4% (10.1 v. 12.5%).

• In a comparison of the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 1.5% (13.6 v. 12.1%).

• Short sales comprised 4.4% of new listings and 6.3% of sales in the first quarter of 2014, down 1.6% and 0.5% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 5.7% of new listings and 7.3% of sales in the first quarter of 2014, down 0.8% and up 2.0% from the fourth quarter of 2013, respectively.

Portland metro when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 1.7% (8.9 v. 10.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 0.2% (11.0 v. 10.8%).

• Short sales comprised 4.3% of new listings and 6.1% of sales in the first quarter of 2014, down 1.7% and 1.1% from the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 4.6% of new listings and 4.9% of sales in the first quarter of 2014, even with and up 1.3% from the fourth quarter of 2013, respectively.

Clark County when comparing percentage share of the market, first quarter 2014 to fourth quarter 2013:

• When comparing the first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of new listings decreased by 6.1% (12.5 v. 18.6%).

• In a comparison of first quarter 2014 to fourth quarter 2013, distressed sales as a percentage of closed sales increased by 5.5% (23.1 vs. 17.6%).

• Short sales comprised 5.9% of new listings and 10.9% of sales in the first quarter of 2014, up 2.3% for new listings and 1.8% for sales when compared to the fourth quarter of 2013, respectively.

• Bank owned/REO properties comprised 6.6% of new listings and 12.2% of sales in the first quarter of 2014, down 3.8% and up 3.7% from the fourth quarter of 2013, respectively.

If you’d like more information or percentages of distressed residential sales in other areas not represented by our charts, please contact us at communications@rmls.com.

by RMLS Communication Department | Feb 14, 2014

UPDATE (April 25): Office Exclusive Changes Finalized

RMLS™ has finalized changes to office exclusive policies, effective May 5, 2014.

————–

UPDATE (February 28): Office Exclusive Changes to be Delayed

A significant number of questions were raised when we outlined changes to the office exclusive form, rules, and contracts. RMLS™ will be delaying the release of these changes until we can work through these concerns and clarify details. If you have a comment, please email communications@rmls.com. We anticipate this process will be worked out by the end of March.

————–

There has recently been a lot of national buzz about pocket listings. The RMLS™ Board of Directors and Rules Committee received several inquiries over the past year about the practice, and how pocket listings affect our own real estate community. So at the November 2013 meeting of the Board of Directors, the Office Exclusive Task Force was appointed to evaluate the issue of office exclusives and pocket listings.

The Office Exclusive Task Force was comprised of five members of the RMLS™ Board of Directors: Mark Meek (Task Force Chairman), Rick Jenkins (Chairman of the Rules and Regulations Committee), Ed Petrossian, George Perkins, and Steve Lucas. They looked at and discussed our current policies and rules regarding Office Exclusive listings and various interpretations among subscribers about List Date and Date Marketing to Begin.

Their recommendations were presented to the RMLS™ Board of Directors at their February 2014 meeting. The recommendations were approved and will take effect March 3, 2014. Three documents are affected:

- The Office Exclusive Addendum (Authorization to Exclude) form has been totally revamped. This form will be required when a seller elects to opt out of placing their property in RMLS™ along with a copy of the Listing Agreement. This new form informs the seller(s) of the risks of excluding their property from the multiple listing service (MLS).

- The RMLS™ Rules and Regulations were modified to define marketing and clarify the difference between the effective date of a listing, when all the necessary signatures have been obtained, and the Date Marketing to Begin which can be a later date. Also, a new sanction was added for marketing of a property prior to publication in RMLS™.

- The Listing Contract language for Oregon and Washington was changed to be in harmony with the changes to the RMLS™ Rules and Regulations.

The Office Exclusive Addendum will now cover all the benefits of MLS publication so that the seller is fully informed. Some of the concepts include the wide distribution of property information to more than 10,500 other real estate brokers who subscribe to RMLS™, bringing together buyers and sellers in an efficient marketplace. RMLS™ subscribers are REALTORS® who abide by the NAR Code of Ethics. Cooperation among brokers from many brokerage firms, by including the listing in the MLS, increases a seller’s chances of identifying a qualified buyer and obtaining fair market value for the property. It also helps provide a rich database in which subscribers can identify comparable properties for CMA reports and valuable statistical information.