by RMLS Communication Department | Dec 15, 2009

Sales up, but in comparison to a dismal month last November

The big highlight this month for many areas is a large jump in closed sales compared to last November. Curry County posted a 141.7% increase and Portland and Clark County set records for percentage increases in same-month sales at 72.4% and 70.5%, respectively.

While these stats are obviously a good sign for market activity, continue to keep in mind that last year we were at the height of the economic crisis and we hit some of the lowest points in sales totals in recent years. So, yes, sales are way up compared to last year, but remember that we’re comparing it to unusually low sales totals.

Has the winter slowdown arrived?

Closed sales had been on the rise in many key areas month-to-month through October, but it appears that the winter slowdown has arrived. Compared to this October, pending and closed sales were down in most areas, including Columbia Basin, Douglas County, Lane County, the Mid-Columbia region, Portland and Clark County.

Inventory up

Inventory ticked up in every area except Curry County and Union County, however, most areas are well below last year’s inventory levels thanks to fewer listings entering the market and higher sales totals. For example, Portland’s inventory stands at 7.1 months – 53% less than last November’s 15 months of inventory.

by RMLS Communication Department | Oct 16, 2009

Residential real estate sales tick up in several areas, inventory down

This month’s RMLS™ Market Action report showed a trend of increasing real estate sales & subsequently lower housing inventory in many areas of Oregon & Southwest Washington.

Sales Activity:

Closed sales rose in the following areas this month, compared to the same month in 2008:

| Area |

Closed Sales |

| Curry County, Oregon |

100% |

| Columbia Basin, Oregon |

36.6% |

| Lane County, Oregon |

23.2% |

| Clark County, Washington |

20.2% |

| Portland Metro, Oregon |

9.8% |

Third Quarter Sales Up:

September marked the end of the third quarter and compared to Q3 in 2008, Coos County, Curry County, Douglas County, Lane County, Portland and Clark County all saw sales outpace Q3 in 2008. Clark County led the pack at a clip of 18.7%.

Inventory:

Ten of eleven areas that we cover in the Market Action report saw housing inventory drop from August. This can be attributed to rising sales in several areas and as we head into the slower fall & winter seasons, fewer homes are being listed as well.

Both the Portland and Clark County areas saw inventory drop to 7.6 months. Lane County has the lowest inventory of the areas we cover at 6.8 months.

by RMLS Communication Department | Sep 28, 2009

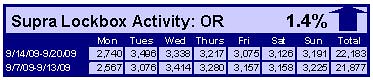

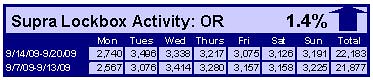

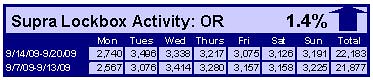

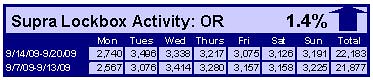

Lockbox Activity Down In Washington, Up In Oregon

When comparing the week of September 14-20 with the week prior, the number of times an RMLS subscriber opened a Supra lockbox decreased 1.2% in Washington and increased 1.4% in Oregon.

Click the chart for a larger view (Washington, top; Oregon, bottom)

Archive

View an archive of the Supra lockbox statistical reports on Flickr.

![When’s the Next Market Action Coming Out?]()

by RMLS Communication Department | Sep 8, 2009

When to Expect the Latest Market Reports from RMLS™

This is a frequently asked question from subscribers here in my cubicle, so I thought I’d put the answer in writing.

My standard line is that Market Action is released around the 15th of each month. “Around” means it could be a day or two before, or a day or two after. It all depends on where the weekend falls.

We don’t generate any statistical reports for Market Action until the 10th day of each month. The reason we wait is to assure that almost all transactions are recorded in our database. If we were to run the reports on the 1st or 5th of each month, there’s a chance that many sales that occurred in the prior month might not be reported on RMLSweb yet. So, to assure what we report is an accurate reflection of what happened in the market that month, we wait until the 10th.

Editing time.

However, sometimes due to where the weekend falls, we can’t start working on the reports until the 11th, 12th, or sometimes even the 13th. Generating the reports, publishing, editing, posting and e-mailing then takes roughly 2.5 days of work.

So, for example, this month, I’ll start working on Thursday the 10th. But, I have to pause for the weekend, so the likely release date is Monday, September 14 or Tuesday, September 15.

Tip: If you’re eager to see the data, you can get a basic report on RMLSweb on the 11th of each month. The Home Sales Report (HSR) has a lot of the same data that we report in Market Action (number of sales, sale price, active listings).

The HSR can be accessed on RMLSweb by scrolling over Back Office and clicking on Home Sales Report. Then expand the folder for the year that you want, then the month, and then select the area you want to look at. If you want to look at the report for a broad area (such as the Portland Metro area), open the document that reads “combined report”. You can also look at reports for individual MLS areas or counties.

![When’s the Next Market Action Coming Out?]()

by RMLS Communication Department | Aug 24, 2009

There’s been some encouraging news lately in the RMLS™ market areas. The number of sales and pending sales are finally outpacing the totals from the same month in 2008. How much of it might be a result of the $8,000 first-time homebuyer tax credit, though?

I recently put together some statistics for the Oregonian on the Portland metro area, and thought I would share them with you.

There is no question that home sales in the lower-end of the market have seen a big jump this year. In 2007, homes priced between $0 and $249,999 only made up 35% of all sales in the Portland metro area. In 2009 so far, they make up 49.6% of the market.

As you’d expect, coinciding with the increase in lower-end homes is a drop in high-end homes. Homes priced $500,000 or above have dropped from 13.5% of the market in 2007, to just 8.2% of the market this year.

Click on the graph for a larger view

The question is: what will happen when the $8,000 tax credit expires on December 1?

I know the tax credit definitely got me off the fence & I can literally think of 15 of my friends and acquaintances (off the top of my head) who have bought or are actively looking to buy.

So in my humble opinion, there’s little doubt that the tax credit spurred people to buy. But as the deadline for the credit approaches, it should be interesting to see where sales go.