The Rules Roundup provides a monthly accounting of RMLS rules violations and courtesy notifications. Our Data Accuracy team manages all reports of property listing errors, tracking 34 specific issues outlined in the RMLS Rules and Regulations, and is responsible for addressing subscriber questions and concerns regarding listing accuracy.

HIGHLIGHTS

Agent reported violations are down 16% year-to-date from this time last year. This may be due to overall low inventory, less overall violations, or just less reporting of those violations, but it’s important to remember that RMLS relies on our subscriber’s assistance to help identify inaccuracies so that we may both address the inaccuracies and inform subscribers on how to avoid such errors. Accurate data matters highly to everyone in the real estate industry. Check out The Lifecycle of a Reported Issue to learn more about how we process these entries.

FORMAL VIOLATIONS

The RMLS Rules and Regulations Committee reviews all formal complaints which allege a violation of the RMLS Rules and Regulations. The committee has the power to impose sanctions.

The committee did not review any cases in May 2022.

INFORMAL VIOLATIONS

Listings missing Tax ID information are consistently the top informal violation within RMLSweb.

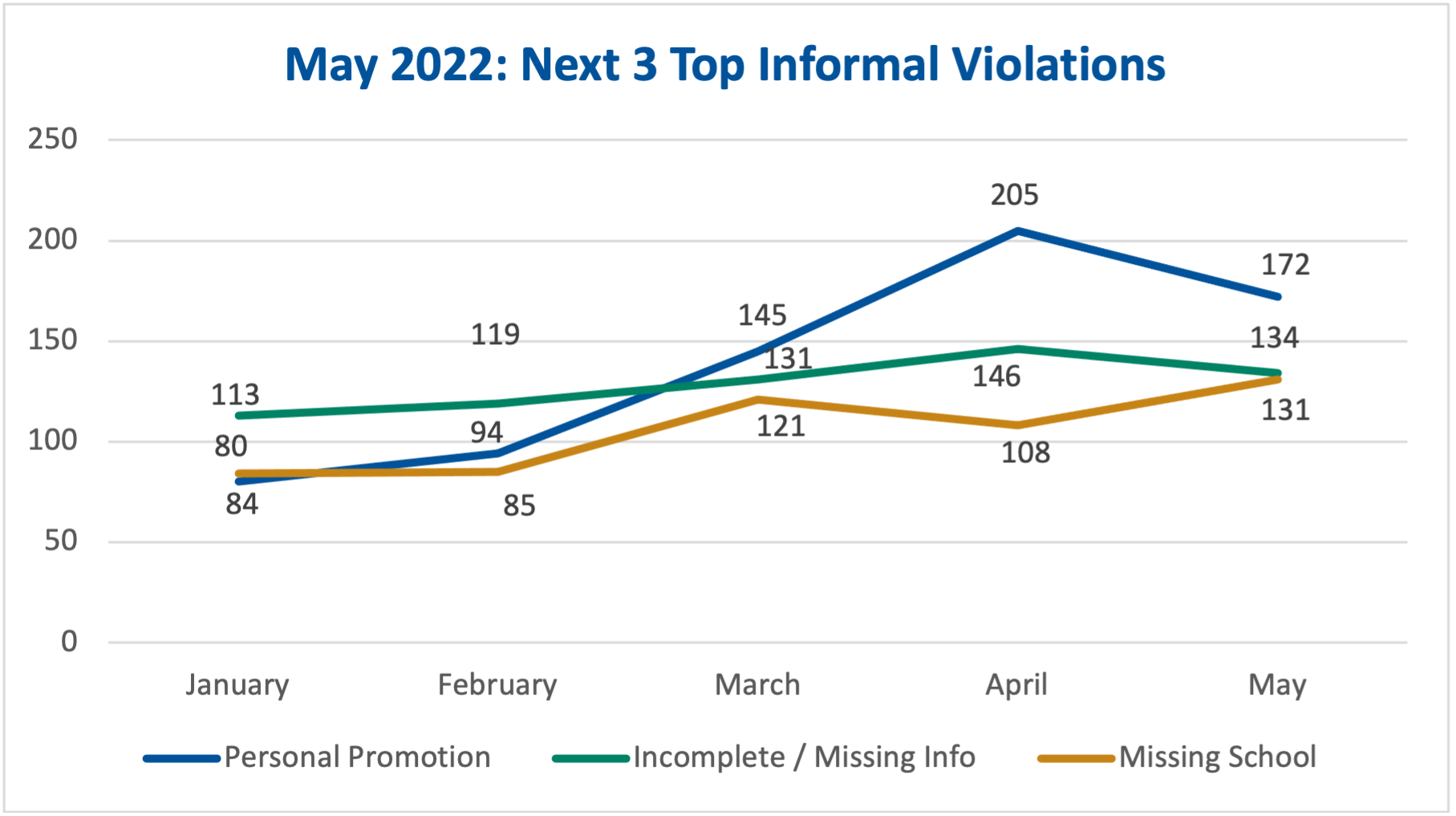

The chart below shows the next three most frequent informal violations from May 2022.

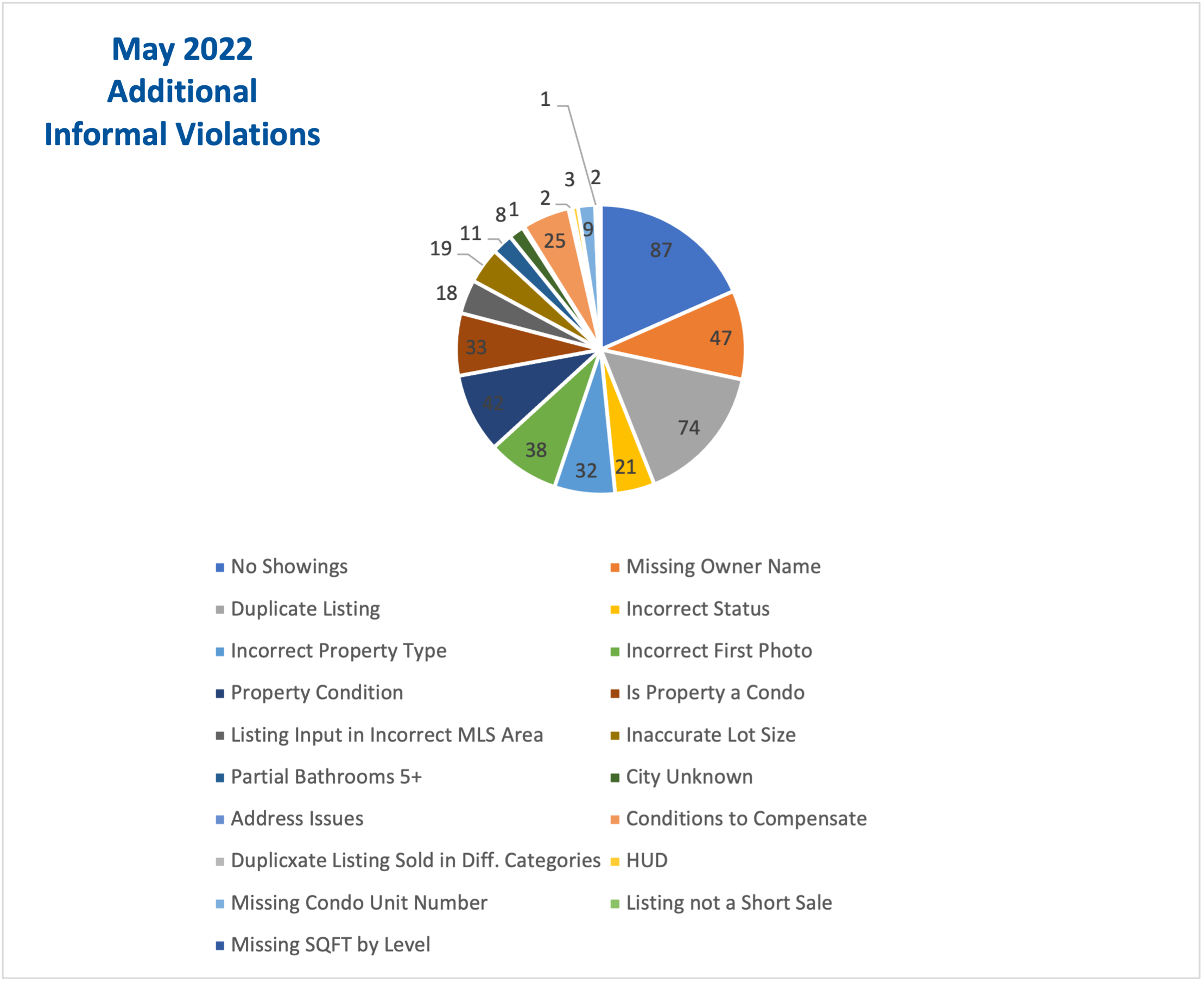

This pie chart shows the remainder of the informal violations last month.

Data Accuracy Department Statistics

- Listings Reviewed: 21,391

- Notices Sent: 2885

- Violation Notices Received: 409

- Courtesy Notices Sent: 2147

- Phone Calls Received: 460

How to Report Violations

Subscribers have multiple options to report violations, including a Report Issue button on every RMLSweb listing. Subscribers can email our Data Accuracy team at dataaccuracy@rmls.com or call them at 503.395.1916. When there are increases in specific violation types, we sometimes place notifications on RMLSweb.

I Love RMLS, the staff are amazing and quick with help. Thank you for everything you go for our Industry.

Thank you, Ronda! We’re so happy that you’re pleased and we look forward to continuing to provide you great service.

OK, so what is a real estate broker leaving out of the listing in the form used that triggers the listing to go missing Tax ID information? Provide some specific direction, please. Thank you!

Thanks for your question, Linda. In this case, we’re referencing listings where the Tax ID field for a listing has been left blank. Sometimes that is due to an error where the listing agent neglects to include that information. Other times, it may be because the listing is a new construction property that does not yet have a tax ID number available. Our Data Accuracy department sends courtesy notices out to remind the agents of the need to provide the tax information (when available).