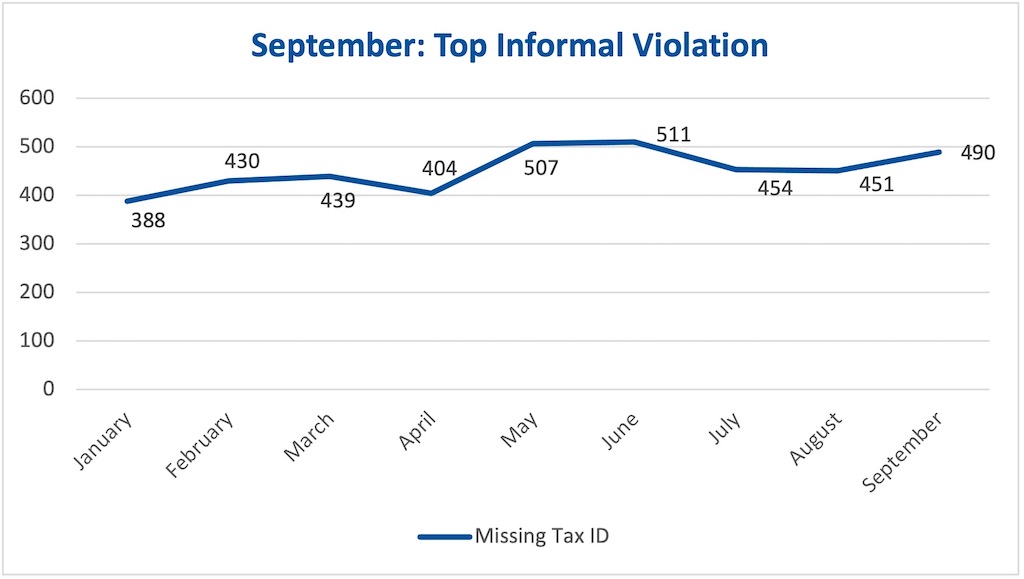

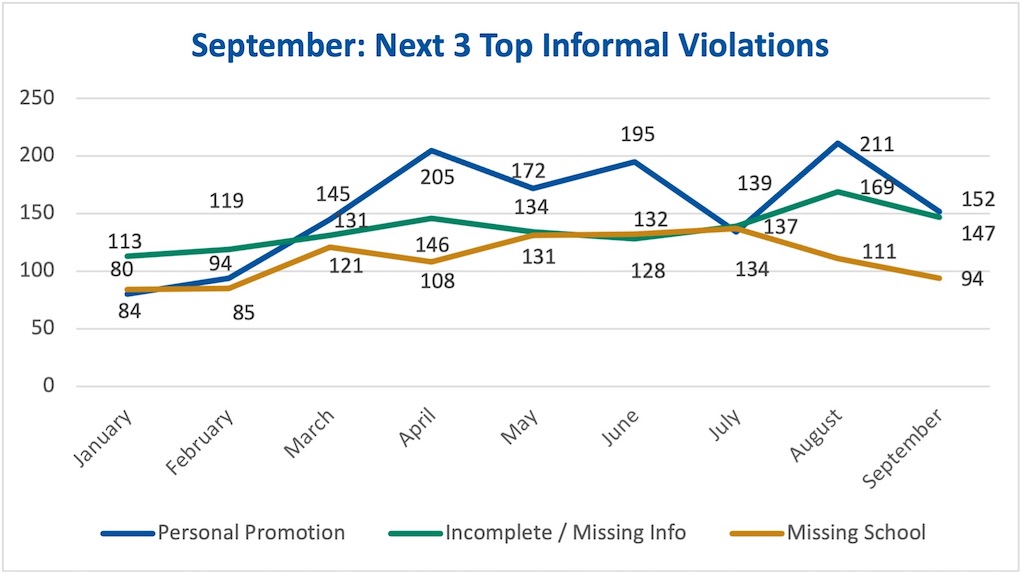

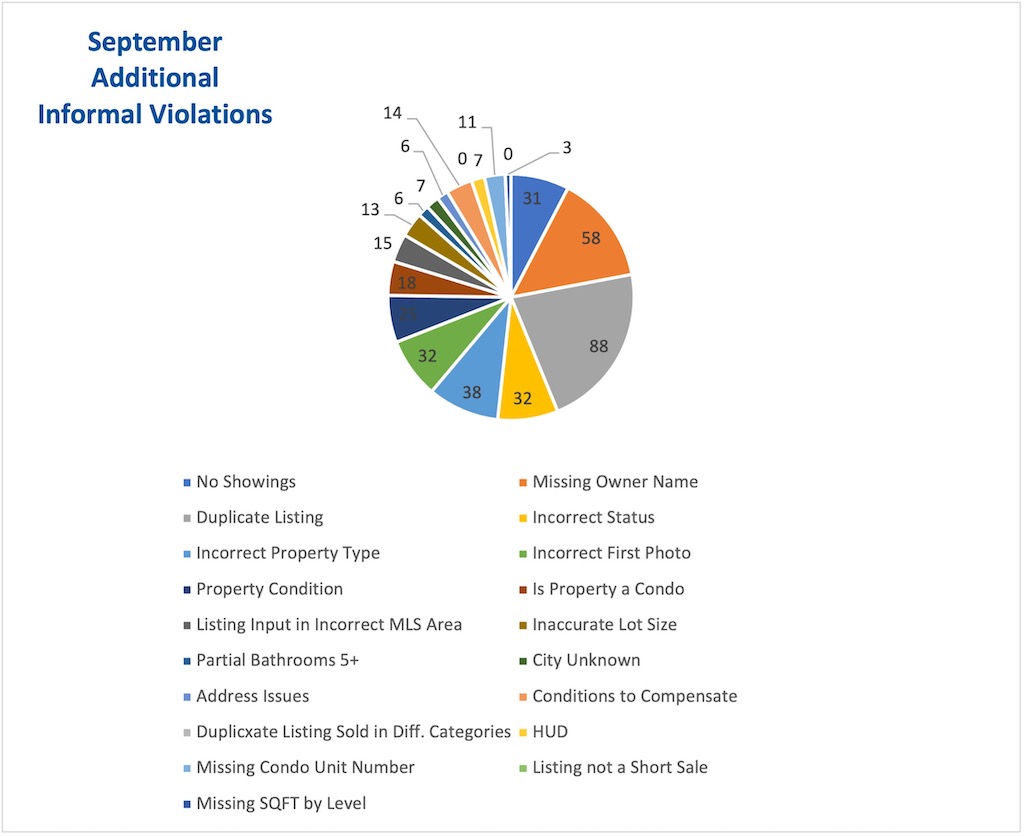

The Rules Roundup provides a monthly accounting of RMLS rules violations and courtesy notifications. Our Data Accuracy team manages all reports of property listing errors, tracking 34 specific issues outlined in the RMLS Rules and Regulations, and is responsible for addressing subscriber questions and concerns regarding listing accuracy.

HIGHLIGHTS

Our listing checker and violation software have received technological upgrades as part of our data feed move to a RESO-compliant Web API. As a result, a few changes have been made to the system and settings.

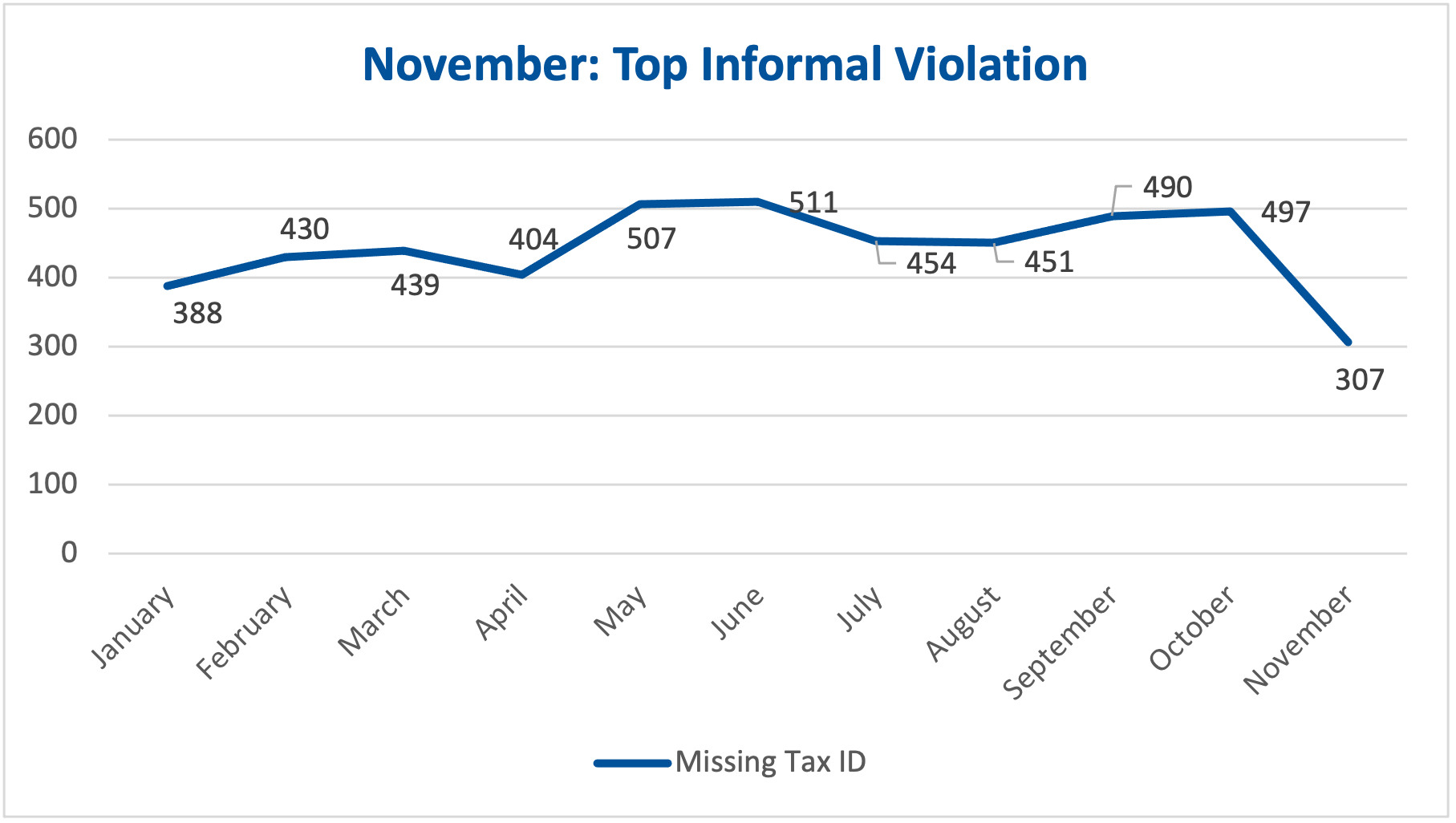

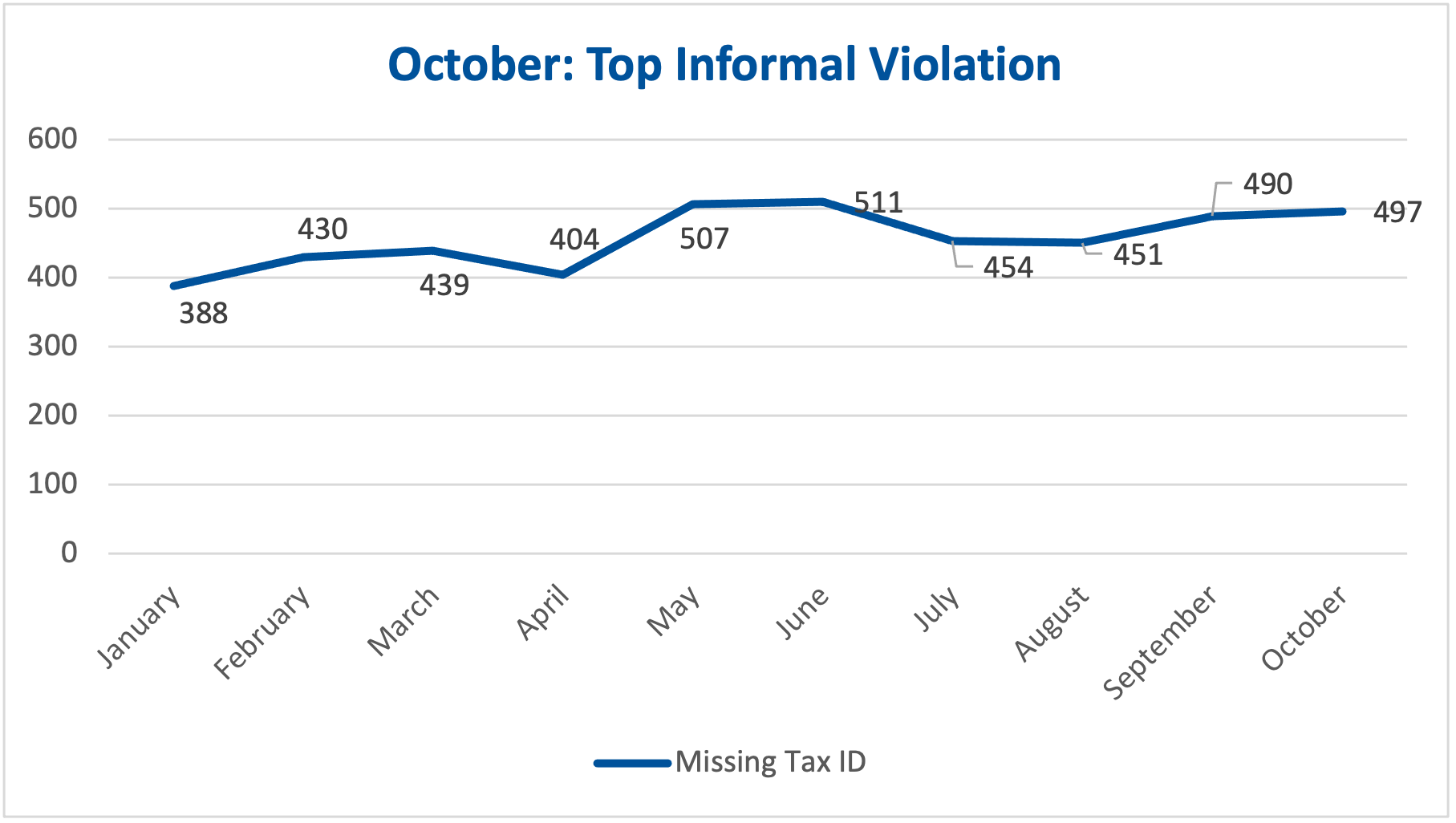

Missing Tax ID Violations: This type of violation will now exclude “proposed” and “Under Construction” property conditions, meaning that these property conditions will no longer receive a Missing Tax ID violation unnecessarily. This will also cause the stats for that violation to decrease significantly, as reflected in the November statistical data.

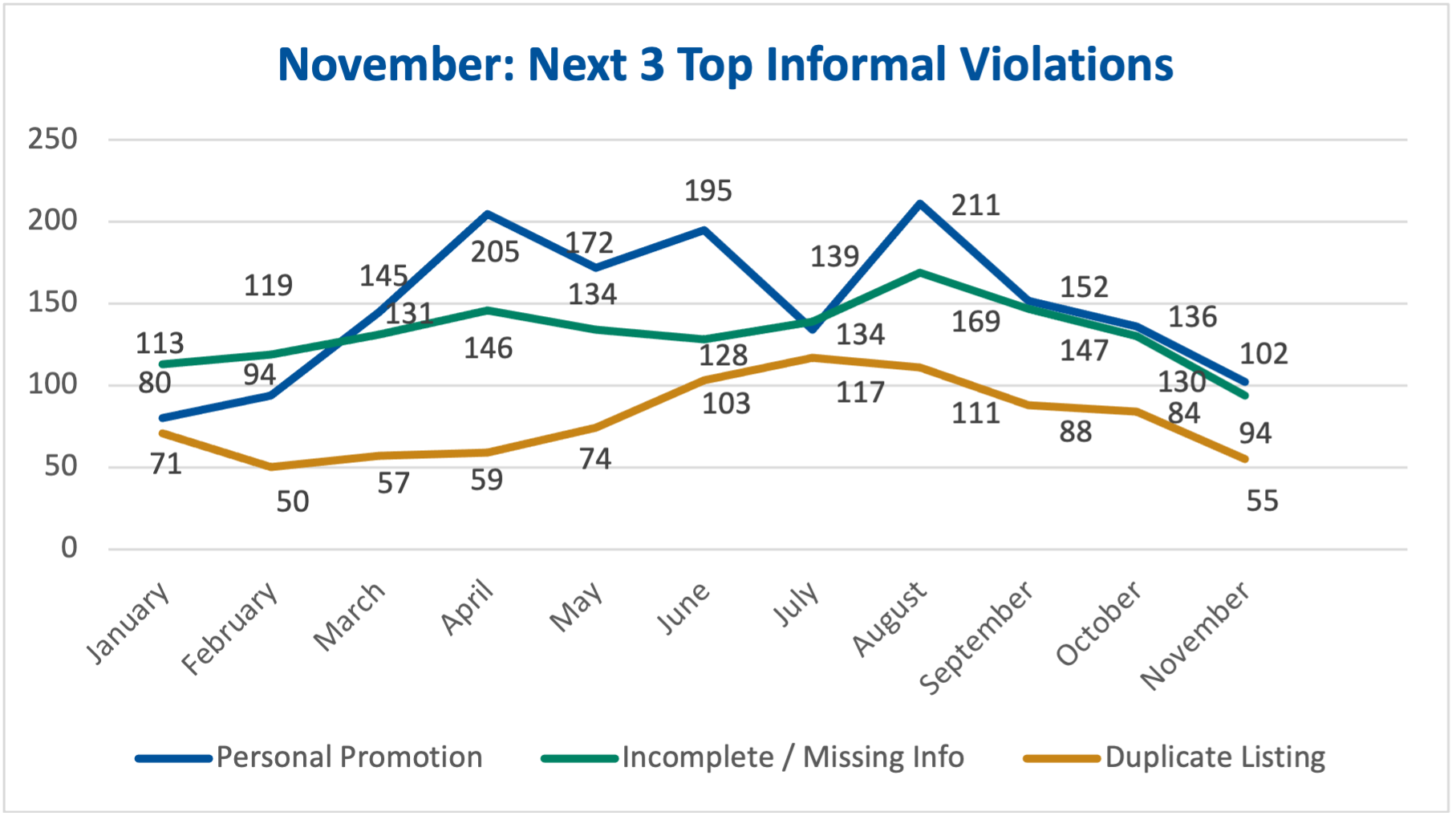

Artificial Intelligence: We’ve recently incorporated Restb.ai, which uses artificial intelligence to evaluate the metadata in property photos, into our process to check all uploaded photos for violations. This will add new statistical data on violations and greatly improve our reach and accuracy regarding photo violations.

The software is set up to look for violations regarding the first photo, personal promotion, people, unauthorized text, and unauthorized watermarks. This data will begin to be reflected in the December statistics.